The crypto market took it to the chin early on Friday, but it wasn’t the industry’s fault. Instead, it was weak economic data that caused the sale. If you’re wondering why cryptocurrencies aren’t hedges against the economy and inflation, you just look at history. When the economy last slowed and inflation jumped, Bitcoin’s value collapsed.

As of 1:30pm ET, Bitcoin in the last 24 hours (Cryptography: BTC) Ethereum is down 3.6% (Encryption: ETH) 6.3%, it’s Dogecoin (Cryptography: Doge) It’s down 4.9%. Can the decline continue?

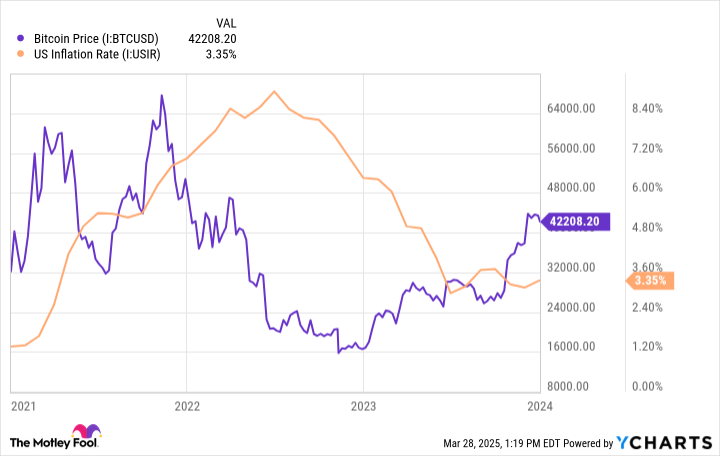

Like it or not, cryptocurrencies trade in more correlation with growth stocks than as hedges against inflation or the broader economy. In general, low interest rates are good and high interest rates. In the related memo, low inflation is suitable for crypto, while high inflation is bad.

In particular, Bitcoin is sold as an inflation hedge, but history says it’s the opposite.

And it brings us to the economic data that has come out today. The PCE price index, which measures personal consumption expenditure, rose 2.5% from the previous year as expected, but Core PCE rose 2.8%, with the January core PCE being revised upward. This was ahead of the impact that tariffs had on future product prices.

Higher prices put pressure on the Federal Reserve. This will allow the economy to increase at low interest rates, but may need to raise prices to offset inflation. It’s in a tight spot, with a higher rate going to be bad for cryptocurrency valuations.

Another data point for today is the University of Michigan Consumer Sentiment Index, which fell to a 57 read in March, dropping the conference committee’s expected index to 52.6. Higher reading means consumers are becoming more bullish towards the economy, while lower reading shows the opposite.

Lower reliability and rising prices are bad combinations for the market, especially for dangerous assets like crypto.

The reality of crypto investors is that the worst may still be ahead. The rising prices appear to be here to stay considering rising tariffs and potential trade disputes with all countries that supply goods to the US.

A weak economy and high inflation can make cryptocurrency awful. Crypto is a risky asset and there is no actual utility today. So, if people need funds, they could sell Crypto or at least buy less. With no underlying business, the value of cryptocurrency remains viable depending on the next buyer. Buyers can be exhausted in a bad economy.

The story continues