(Bloomberg) – Cryptocurrency investors lock themselves out of profits from digital assets that are ostensibly prohibited from selling by entering into complex arrangements with specialized trading companies.

Most of them read from Bloomberg

Seven people familiar with the issue say that venture capital companies and other investors sitting in tokens that cannot be traded in open markets are working with companies that create the market to hedge positions.

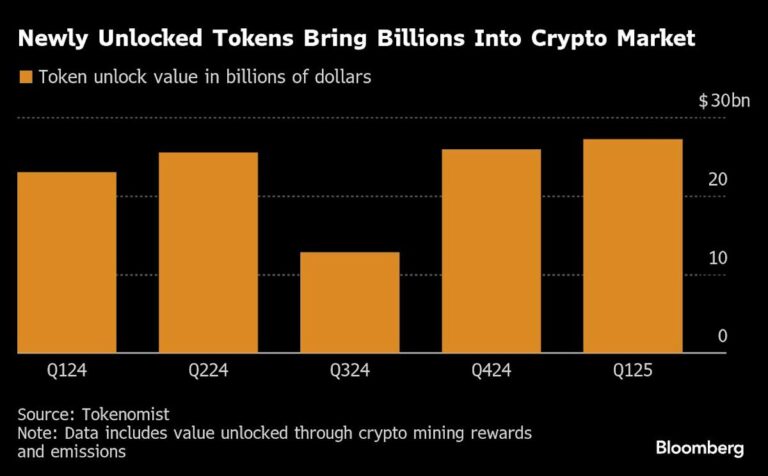

According to Coingecko data, the total amount of all digital assets in circulation nearly doubled in 2024, but venture investors in the industry are struggling to generate concrete returns. The recent dip in token prices – Bitcoin is currently more than 25% below the $109,241 record set in January – suggesting that investors may have a vanishing window to realize profits.

Trading companies are stepping in to ease the pressure by “building two-sided books on these tokens that exist outside of centralized exchange.”

According to spokespersons for these companies, Wintermute, Flowdesk and Caladan are among the market makers taking the opposite side of such transactions. According to those familiar with the issue, GSR and Nomura Holdings Inc. Laser Digital are also active in the space. Laser and GSR declined to comment.

“We have witnessed the rapidly developing secondary market of locked tokens since mid-2023,” said David Bachellier, chief market officer at Flow Desk. “While it is not a fully functional two-way market for a variety of reasons, demand suggests great potential for innovation and growth.”

Token Love

Early supporters of crypto projects are often given to not only tokens, but also in lieu of stocks. Tokens are usually eligible for the Best Program. That means it’s unlocked according to last year’s schedule. As a result, they cannot sell in open markets during that time.

According to a report by Tokenomist, the five biggest unlocks in 2024 led to more than $5.4 billion in tokens being circulated.

Unlocking can raise sales pressure in a hurry to book profits, allowing it to weigh the token price. To hedge that risk, token holders are seeking support from market makers and other funds.

The story continues