No more questions. President Donald Trump and his family are profiting from cryptocurrency ventures while holding the country’s highest office.

The numbers speak for themselves.

The Trump family’s net worth has swelled at $2.9 billion in just six months, with nearly 40% of which now tied to crypto assets.

These include meme coins such as $Trump and $Melania, as well as control over World Liberty Financial (WLF).

It’s hard to miss the ethical red flag.

WLF is receiving a $2 billion increase from MGX, an Emirati-backed investment fund. MGX plans to use Trump-affiliated USD1 Stablecoin to close a massive deal with Binance.

The Trump-related group owns 60% of WLF, $22.5 billion in WLF tokens, and receives 75% of future token revenue. The Trump family doesn’t just get it on paper. They can make real money from transaction fees and individual transactions.

The emergence of injustice is not theoretical. Since Trump re-inaugurated the office, the administration has suspended multiple SEC investigations of crypto companies. The timing of these rollbacks coincides with the spike in $Trump’s price and the sudden firing of legal action against WLF investors Justin San.

Sun dumped $75 million in the WLF just before taking office, and a month later the SEC called for a pause in his fraud case.

Don’t forget to play the $Tram Coin “Dinner”.

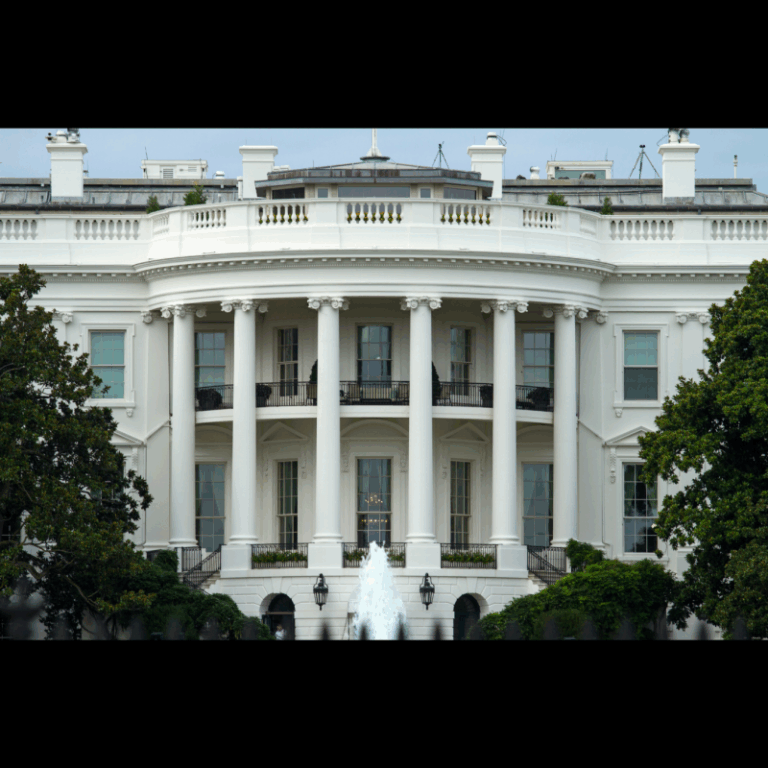

The top 220 coin holders are promised receptions, dinners and White House tours. This is one with special access to the Top 25. This is not just sticky, it’s a direct sales closer to the president.

The more you buy $trump, the closer you will. After this announcement, the value of tokens has skyrocketed by over 50%. This means Trump himself, where business makes up a large part of the coin, profiting from the promise of access. If this is not textbook corruption, what is it?

To be clear, Trump is not subject to the Criminal Dispute Act. However, he is subject to government law ethics law and requires asset disclosure. His next report will be on May 15th. In my opinion, Americans deserve full transparency.

Like Coinfund’s president, Chris Perkins, supporters have dismissed criticism as a political stance. “If Trump bans stubcoins because he has a project, we may ban real estate too,” he said.

But that discussion misses the point. This is not about hating Trump’s business ventures. It is an unprecedented scale of overlap between the president’s power and personal financial interests, especially in opaque markets like crypto.