The reason is simple: it will cost more to insurers to replace damaged car parts that are subject to customs duties.

“When you get involved in an accident, your car insurance company is a company that plans to buy those parts to repair your vehicle,” says Terrence Lau, dean of law at Syracuse University, formerly a trade lawyer at Ford Motor Co.

Tires are just an example. Almost 80% of the world’s natural rubber exports come from five countries: Thailand, Indonesia, Ivory Coast, Vietnam and Malaysia. So, our based tire plants have to pay more for the raw materials they rely on overseas suppliers to provide.

Many vehicles are vulnerable to multiple Trump administration tariff policies to separate steel and aluminum taxes from the automotive industry itself, pushing taxes on chips, and separating taxes that take away global import taxes.

The large international supply chain in the automotive industry means that there are no vehicles built entirely domestically with American-made parts. Nearly seven of the 10 new cars have been assembled overseas, according to NBC News analysis of National Highway Traffic Safety Management Data. Additionally, six in ten of the replacement parts have been imported, data from the American Property Casualty Insurance Association shows.

Vehicles are jumping out of dealer lots as consumers try to preempt tariff-related price increases. Retail sales released by the Commerce Department on Wednesday showed car sales, with parts dealers rising 5.3% from February to March.

According to Cox Automotive, heavy-duty demand has reduced daily supply of new vehicles. Used vehicle inventory fell from the 43rd to the 39th, the group found.

As people stick to the wheels for longer, industry experts can foresee higher demand for second-hand cars and raise prices in that market as well.

“If you’re doing something financially responsible and driving a 10- or 15-year-old vehicle until the wheels drop, the general maintenance costs increase,” said Ivan Drury, director of Insights at Edmunds.

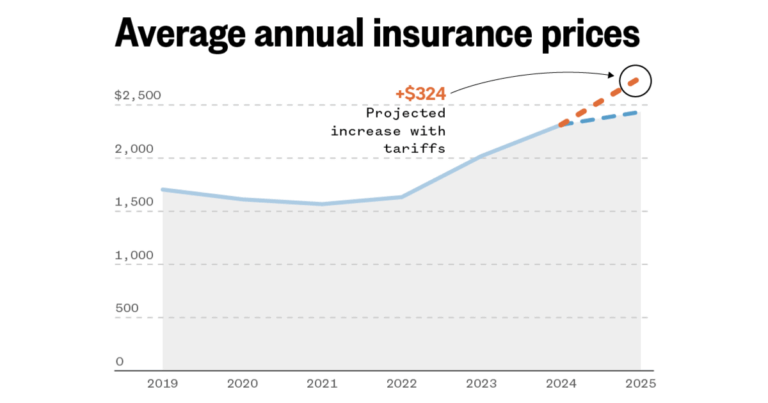

Drivers whose insurance policies are scheduled to be renewed later in the fiscal year are likely to see some of the initial price increases, experts say. These expected hikes can vary from state to state, and we guarantee an estimate that New York and Florida are set to see the steepest.