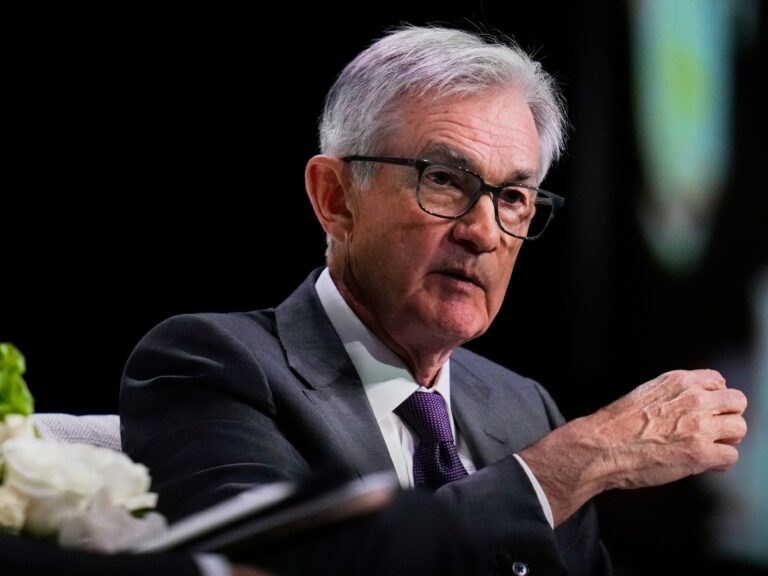

US President Donald Trump has suggested that Federal Reserve Chairman Jerome Powell amid the president’s complaints that central banks do not actively cut interest rates.

On Thursday, Trump said Powell’s “end can’t come quickly enough.”

Powell’s term of office will not expire until May 2026. The president has no authority to remove Powell from the central bank.

Trump’s attack on Powell comes after a speech by the Fed chairman at the Chicago economy club on Wednesday. Powell said the Fed will only make decisions about what is best for all Americans.

“This is the only thing we’re trying to do,” Powell said. “We are never influenced by political pressure. People can say whatever they want. That’s fine. That’s not the problem. But we do strictly do things without taking into account political or other unrelated factors.

“Our independence is a matter of law,” continued Powell. “We are not removable except for the cause, and we serve a very long term.

Republican President Broadside comes the day after Powell signaled that the Fed would not change key interest rates, but is asking for “more clarity” about the impact of policy changes in areas such as immigration, taxation, regulation and tariffs.

Powell also reiterated that Trump’s tariffs are likely to raise inflation and slow the economy. The Fed chair proposed that central banks focus on fighting inflation in the wake of tariffs, even if their duties weaken the economy. Powell’s comments helped the stock price fall on Wednesday.

Trump pushes back

In a social media post, Trump pushed Powell back, saying, “Oil prices are falling, groceries (and eggs too!) are falling, and the US is rich in tariffs.”

On the contrary, crude oil prices have risen by 2% over the past two weeks. According to the latest April consumer price index report, grocery prices have actually risen under Trump, with egg prices reaching record highs following the same report last month. Last week, the president falsely claimed that the US brought in $2 billion a day thanks to tariffs. It was 200 Mid Day.

Looking at the European Central Bank (ECB), Trump said Powell should have said, “We should have lowered interest rates like the ECB, but he certainly should cut them down. Powell’s firing will not be quick enough!”

On Thursday, the ECB cut its main interest rate from 2.5% to 2.25%.

Powell was originally appointed by Trump in 2017 and in 2022 he was appointed to another four-year term by former President Joe Biden. At a press conference in November, Powell indicated that he would not resign if Trump asked him to resign.

Trump’s comments come in the background of a Supreme Court lawsuit that allows the president to determine whether he can fire the head of independent agencies such as the Fed.

The incident stems from the firing of Trump officials from two independent agencies. Last week, the Supreme Court had the shots fired while considering the case. This summer, there could be a broader ruling that would allow the president to fire Fed officials, including the chairman.

Powell said the Fed is closely watching the incident, adding that it may not apply to the Fed. Lawyers for the Trump administration argued that by allowing the president to fire two officials, he would not erode the Fed’s independence.

“It’s difficult to exaggerate the outcome at this emphasised moment when President Trump discovered he had the authority to dismiss the head of independent agencies, and did not establish a clear Fed sculpture.” “If you like tariff fiasco in the market, you want a Fed-independent loss of trade.”

Customs mayhem

Powell started Trump’s second season in a relatively safe spot. The low unemployment rate could have led to inflation approaching the Fed’s 2% target, which could have spared the US central bankers from President Vitrio.

But Trump’s aggressive and accidental tariffs pose a recession threat with both higher inflationary pressures and slower growth. This is a tough place for Powell, which is about stabilizing prices and maximizing employment. As the economy weakens due to Trump’s choices, the president appears to be trying to lock Powell’s responsibility down.

Trump has released a tariff rash that has put the US economy and the Fed in increasingly dangerous places.

On April 2, the president announced a 90-day suspension, which deployed aggressive tariff hikes with other countries based on the US trade deficit, causing financial market rebounds, and which charged 10% tariffs to most countries while negotiations progress. But Trump has increased tariff hikes in China to 145%, along with existing tariffs on Canada, Mexico, automobiles, steel and aluminum.

Wall Street banks such as Goldman Sachs have increased the chances of a recession beginning. Consumers are increasingly pessimistic in research into employment outlook, fearing that inflation will intensify if import tax costs are passed. The risks of stagflation – stagnant growth and high inflation – make it difficult for the Fed to respond in the same playbook as the recent recession.

Yale University’s Budget Institute estimated that the increase in inflationary pressure from tariffs equals a loss of $4,900 for the average US household.