The Trump administration wants to bring more car manufacturing back to the US with rigid tariffs. It means a supply chain that is round the corner where borders are repeatedly intersecting each other, meaning that some industry players don’t know how their revenue will be affected.

Take the Brendan Lane striker plate and move it four times between the US and Canada before installing it. A typical component (one of approximately 30,000 individual parts that enter a single vehicle) is a small metal loop attached to a steel slab that allows the car door to latch firmly into place.

“This system is always installed where we are across the border,” said Lane, general manager of Lanex manufacturing in Windsor, Ontario, across the river from Detroit. His parts are sold to suppliers of major American automakers, including Ford, General Motors and Stellantis, and Lane said he has been travelling across the border for a family-owned company since the age of 16.

He’s been riding the Lanex roller coaster for the past few months as President Donald Trump introduced tariffs on auto parts, steel, aluminum and Canadian imports.

On Tuesday, Trump adjusted tariffs on vehicles to provide relief from import taxes that he threatened to stack on top of each other. Under the revised policy, automakers paying tariffs on imported vehicles may still be subject to country-specific tariffs, but may be refunded for other taxes, including foreign-made metals.

The system is set where we are always crossing the border.

Brendan Lane, general manager of Lanex Manufacturing in Windsor, Ontario

Lane welcomed the change, but said the tariffs were “not good” for his business. He said he continues to worry about how the still-famous US trade policy will affect industry-wide costs and employment.

“Thousands of people are involved in that it’s their everyday lives,” he said.

American automakers primarily outsource the manufacturing of parts, primarily building high value components such as engines, transmissions and bodies within the United States. Most other components, especially minor parts such as hoses, springs, striker plates and other products – are from external suppliers overseas.

Reuse of that massive global supply chain is “not as easy as turning the switch over,” Lane said.

His striker’s plate is spared a 25% US obligation on car imports that are on track to implement on Sunday, as it complies with the US-Mexico-Canada agreement Trump negotiated during his first term. However, Lane said the long-term impact on his business is still unknown.

“It’s hard to plan,” he said. “I don’t know how to navigate yet.”

Even General Motors said Tuesday it was “reevaluating” its business outlook to explain the impact of tariffs that are likely still “important.” “When we become more clear,” he promised to share more with investors.

Ford CEO Jim Farley told CNN on Wednesday that the latest tariff plans “have clear things, but there are a lot of things that have something to do with the administration, boy.”

“Affordable parts is really important to America because we need to keep our vehicles affordable,” Farley said. Ford saw double-digit sales growth in March and April, and people rushed out to buy the car, he added, and the company is extending its employee pricing offer until July 4th.

The White House shows that the confusion is tactical.

“President Trump will create what I call strategic uncertainty in negotiations,” Treasury Secretary Scott Bescent told reporters Tuesday. “The openings of uncertainty become narrower,” he said.

Lane’s striker plates start with imported steel from Wixom, Michigan. Reliance on American-made metals has already resulted in a 25% increase in costs due to Canada’s retaliation fees for US steel and the comparable tax on foreign steel imposed by Trump in February.

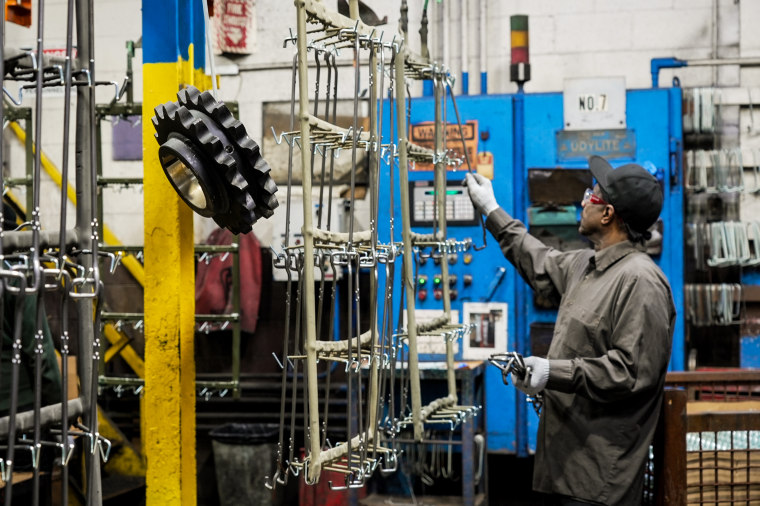

Michigan will move across the border to Lanex’s Windsor factory, and will be shaped into striker plates. The components are then handed over to another Canadian company in nearby Brampton for heat treatment.

The lanes are then the process of returning the parts across the border to Warren, Michigan, to apply a rust-protecting coating. Finally, he takes them to Windsor once more for inspection and packaging in his warehouse. Only then can the striker plate be shipped to a vehicle assembly plant in the US, where it is attached to the door frame.