It’s time for the cryptocurrency sector boom. Ethereum (Encryption: ETH) and Bitcoin (Cryptography: BTC) I’ve picked up another reason why it’s worth a small investment of $1,000, even though I already have a portion of each.

Here’s what happens and why it’s worth investing in advance:

According to Bloomberg, on January 30, the Securities and Exchange Commission (SEC) approved the first part of the application by Bitwise Asset Management. The approval was granted on a quick basis, but now it is likely that the final Go-Aard will soon be coming, at which point it will begin trading in the market.

At the time of the announcement, existing sets of ETFs holding either Bitcoin or Ethereum are approximately $655 million in new cash, so institutional investments consider the total ETF to be a chance to send higher prices for both assets. It suggests that there is a home. It is unclear how expensive it is, but this is a (new) contribution to the investment papers of both coins.

The fact that Bitwise’s future ETFs are trying to provide mixed exposure to both coins at once means that they don’t work exactly the same as other things that investors with traditional financial accounts can normally access I will. In particular, funds function more like Bitcoin than Ethereum, as they are weighted by the market capitalization of Bitcoin and Ethereum. That’s useful. Because investors take advantage of the relative undervaluation of Ethereum at its current price range over the next 3-5 years, without sacrificing most of the common conservative attributes of Bitcoin investments. This means that you can purchase assets that can be achieved. .

What’s exciting is to further integrate Bitcoin and Ethereum into the traditional financial sector, thereby ensuring that both coins have new financial products that will withdraw external cash. Investors need to realize that new ETFs probably won’t be a game changer. Also, these assets need not be worth buying and holding over the long term.

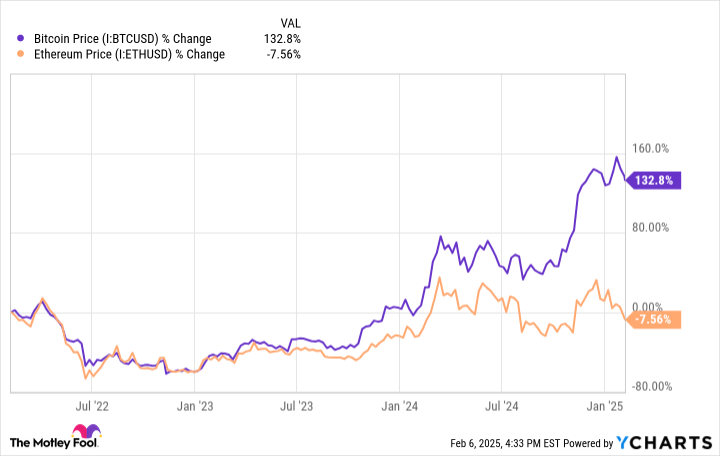

Ethereum and Bitcoin ETFs have been present separately for a while. For reference, here is a chart of the profits of these two coins over the past three years:

When these two coins ETFs begin trading after approval, can you guess based on the charts alone?

If you said in the first bitcoin ETF in early January 2024 and the first Ethereum ETF in late July 2024, you’re right – but if you already know the answer, you probably do so right It will. Simply put, ETF approval and opening trades are not the definitive catalysts for the coin. Look at the price graph for Ethereum since July.

The story continues