On Sunday, a major US Congressional committee approved President Donald Trump’s new tax cut bill, which could pass the House later this week.

The bill extended Trump’s 2017 tax cuts and could reach up to $5 trillion in national debt following the recent downgrade of US credit ratings by Moody’s on Friday.

The United States has the world’s largest citizen debt and faces growing concerns about its long-term financial stability.

What is US debt?

The debt is the total amount owed by the US government to lenders, currently at $36.2 trillion. This accounts for 122% of the country’s annual economic production or gross domestic product (GDP), an increase of around $1 trillion every three months.

The highest debt-GDP ratio was during the 2020 pandemic, when the ratio reached 133%. The US is one of the top 10 countries in the world with the highest GDP to GDP ratio.

What is the debt cap and why does it continue to increase?

If you spend more money than the government collects, you will create a deficit.

To cover this deficit, the government borrows more money. To ensure that borrowings are subject to legislative approval, the US Congress has set limits on the amounts that governments can borrow to fund existing obligations such as social security, health care, and defense. This limit is known as the debt cap.

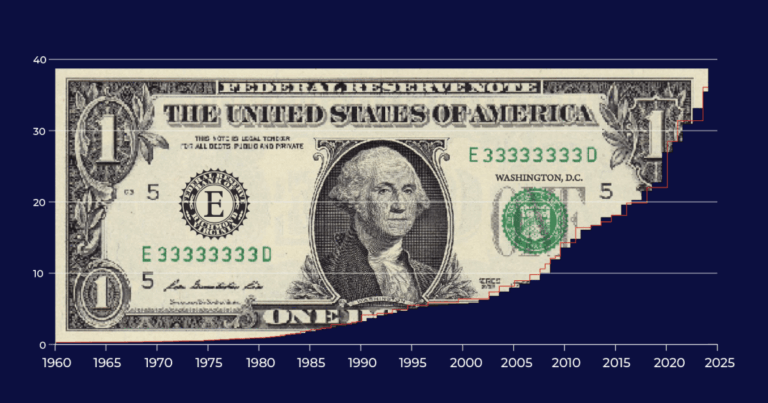

Once you reach the ceiling, the government cannot borrow any more unless Congress raises or stops the limit. Since 1960, Congress has raised, suspended or changed the terms of the debt cap 78 times, allowing the United States to borrow more money.

Federal deficits under various presidents

The federal deficit is spending more money than the government brings in a year. The federal surplus means the US is bringing in more money than it spends.

The deficit rose sharply during Trump’s first term, particularly in 2020, when the government spent a lot while tax revenues fell due to unemployment. That year, the deficit reached almost 15% of the economy (GDP).

Under former President Bill Clinton, there was a federal surplus. This is the result of a favorable economic situation, such as the DOT-COM boom, and a tax hike that has generated more revenue.

What are Treasury Invoices, Memos and Bonds?

When the US wants to borrow money, it changes to the Department of Treasury, the federal government’s finance department.

To borrow money, the Ministry of Finance sells various types of debt securities to investors, including Treasury bills, Treasury bonds, and financial obligations.

These securities are loans made by investors to the US government and are committed to repaying interest.

The US Treasury Department has long been considered a safe asset because the US had a very low risk of failing to pay off investors.

Different debt securities matured at different times. This is when the debt is paid back to the investor.

Treasury bills (T-Billes) are short-term, with Treasury debts (T-notes) mature within one year in medium-term, with mature between two and ten years (T-bond) mature between 20-30 years in long-term.

Who has our debts?

Three-quarters of US debt of $36.2 trillion, or about $27.2 trillion, is being held domestically.

$15.16 trillion (42%) is held by US private investors and entities, primarily in the form of savings bonds, mutual funds and pension funds. $7.36 trillion (20%) is held by US institutions and trusts within the government. $4.63 trillion (13%) is held by the Federal Reserve.

Among the individuals, Warren Buffett is the largest non-government holder of the US Treasury bill, worth $314 billion, through his company Berkshire Hathaway.

Foreign investors hold the remaining quarter, at $9.05 trillion (25%).

Over the past 50 years, the share of US debt held by foreign companies has increased five times. In 1970, only 5% of foreign investors owned. Today, that figure has risen to 25%.

Which countries hold the most foreign debt?

The country purchases US debt to provide safe and stable investments in its foreign currency reserves, helping to manage exchange rates, and providing reliable interest income.

Foreign investors hold $9.05 trillion in debt.

Japan holds $1.13 trillion and the UK holds $77.93 billion, surpassing China in March, and China holds a large amount of US debt, with the Cayman Islands holding $765.4 billion ($45.53 billion).

In response to Trump’s tariffs, both Japan and China have shown that they will use substantial US Treasury holdings as leverage in trade negotiations with the Trump administration.

Earlier this month, the Japanese Minister of Finance said that Japan’s large-scale holdings of the US Treasury could become a “table card” in trade negotiations.

Similarly, China has gradually sold the US Treasury Department over the years. In February, China’s US Treasury Department fell to its lowest level since 2009, reflecting efforts to diversify reserves and continued trade tensions.

What does high US debt mean to the average American?

If the US government spends more on paying off debt interest, it could affect budgets and public spending as it becomes more expensive for governments to maintain themselves.

Governments can generate more income and pay back national debt, increasing costs for the average person. An increase in debt can lead to increased interest rates, making mortgages, car loans and credit card debt more expensive.