(Bloomberg) – The Securities and Exchange Commission launched the New Year with a makeover, cleaned up the slate of crypto-enforcement actions, turning once hostile landscapes of digital assets into a potential heaven.

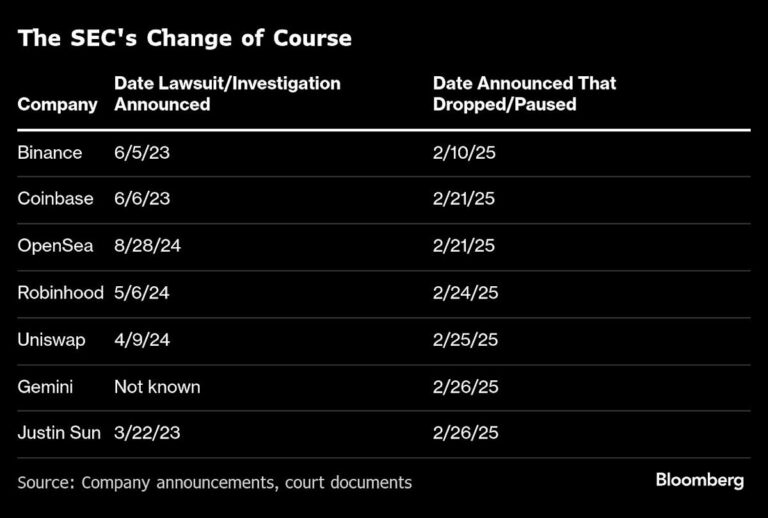

In last month alone, Securities Watchdog fired or suspended at least eight cases against crypto companies, including those targeting some of the sector’s most prominent faces. The running tally includes high-profile lawsuits against Crypto Exchange Coinbase Global Inc and Binance Holdings Ltd.

“This is a multifaceted dismantling of the most successful SEC enforcement program in history,” said John Reed Stark, a former SEC enforcement lawyer and current consultant. Following the election of President Donald Trump, Stark said his message to the institutional world:

The watchdog’s face came quickly after former chairman Gary Gensler left in late January. He is expected to be replaced by former SEC commissioner Paul Atkins, with Mark Ueda acting in that role, and Atkins waiting for confirmation. A SEC spokesman did not immediately respond to requests for comment.

On the campaign trail, Trump pledged to fire Jensler on his first day in office due to his unpopularity in the crypto world. His support provided Crypto’s most valuable asset, Bitcoin, to an all-time high on inauguration day, but subsequent tariff policy decisions fell 25% from their peak.

As the list of abandoned cases grows, executives, analysts and crypto-friendly regulators hope that innovation will flourish.

Citigroup research strategist Alex Sanders said in a memo on Friday: “Regulation clarity should provide more opportunities to innovate, build trust and improve the crypto user experience.”

The charm of America

Under the Biden administration, the US market was seen as a waste of opportunity by crypto executives. Many spoke openly about Gensler and his approach to regulating spaces they considered despotistic in enforcing securities laws against the sector.

Companies such as Coinbase and Ripple have rapidly increased their employment efforts overseas as a result, looking more friendly to other jurisdictions such as Europe, the Middle East and Asia with their business strategy. At the moment, some of these decisions have been reversed, with Ripple promoting 75% of its role opened in US soil in January.

“It appears the whimsical SEC has decided to wake up on the wrong side of the bed, introduce enforcement action, file Wells notifications and submit subpoena for information,” said Cathy Yoon, general counsel for the Wormhole Foundation, an organization that supports blockchain development.

Since taking over the agency on January 21st, changes under Uyeda have been immediate. Over the course of a month, the SEC completely replaced the Crypto Division with new cyber and emerging technology units and launched “Crypto Taskforce,” dedicated to developing rules for the sector, along with industry advisors. TaskForce’s future conclusions have been used as the basis for the SEC’s request to maintain a lawsuit against Binance last month, and have already proven to be essential to the way the institution operates.

Meanwhile, the strength of the debate about whether crypto assets are security or commodities in the eyes of US law has diminished as the threat of enforcement faded. Exchanges like Robinhood, which previously listed tokens like Solana and Cardano because they named the SEC lawsuit potential securities, quickly reinvigorating US client transactions after Trump’s victory. The agency is also more open to applications for exchange trade funds related to such digital assets.

On Thursday, the SEC revealed that tokens that personify internet jokes and viral moments without the promise of utility — are not considered securities in the eyes of staff. Trump himself launched Memecoin in January, and its distribution value surged nearly $15 billion before crashing more than 80%. His family is also closely linked to Crypto Platform World Liberty Financial, which sells more than $1 billion in tokens.

Trump and those who were key supporters of his business have seen their lawsuits being offloaded by the SEC. The agency’s lawyer and Justinsan, a crypto entrepreneur who invested $75 million in world Liberty Financial, jointly called for him to stay in regulatory proceedings on Thursday. Crypto Exchange Gemini Trust Co said a day ago that the billionaire owner tried to donate $1 million in Bitcoin to Trump’s campaign last year, and that the SEC ended its lawsuit against the business without action.

The SEC’s new approach to cryptographic regulations does not mean it is the entire market. According to Joe Castelluccio, partner at Mayer Brown, the SEC’s cyber and emerging technology executive unit includes ensuring retail investors are not caught up in Crypto scams.

“They are looking for an industry that doesn’t build things and break things, don’t ask for permission and return to the more traditional internet spirit. “There’s one big warning about it, but it’s not fooling people.”

The CFTC has long been the preferred regulator of crypto, but he added that it could strengthen its activities in this new environment. “We will continue to see very strong enforcement activities when it comes to fraud, manipulation and market fraud,” he said. “It’s even stronger, perhaps because chasing businesses for technical violations will less distract you.”

The issues continue to rise at Crypto, with the most recent stolen of nearly $1.5 billion of digital assets from Crypto Exchange Bybit on February 21st. Last month, Argentine President Javier Miley found himself at the heart of a crypto scandal.

“Tell me what you do about Gary – he may have been in the way of progress, but he’s got in the way of the crime season,” said Dan Hughes, founder of Blockchain Radix DLT Ltd.

– Support from Nicola M. White and Olga Kharif.

(The SEC added that in the fourth paragraph it did not respond immediately to requests for comment.)

Most of them read from Bloomberg BusinessWeek

©2025 Bloomberg LP