April has been a month of extreme volatility and turbulent times for traders.

From conflicting headlines about President Donald Trump’s tariffs on other countries to the complete confusion about which assets were looking for shelter, it was a record book.

Amidst all the chaos, bright spots emerged that may have surprised some market participants when traditional “haven assets” did not serve as a safe place to park their money: Bitcoin.

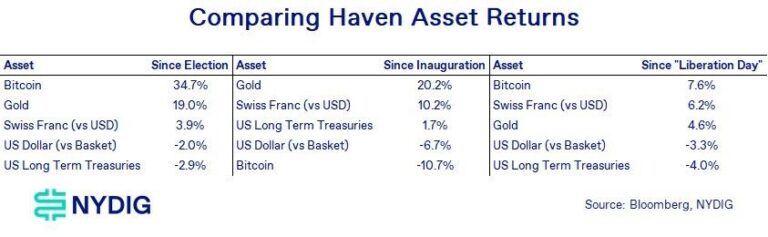

“Historically, cash (US dollars), bonds (US Treasury), Swiss francs and gold have played their roles (safe shelter), with bitcoin rigged across parts of its territory,” says a Nydig study.

Nydig data showed that while Gold and Swiss francs were consistent and safe winners since the “liberation date,” President Trump announced on April 2 that he would swept tariff hikes, kicking extreme volatility in the market was added to the list.

“Bitcoin wasn’t functioning like the liquid lever version of the Lever Red US Equity Beta.

Zooming out, investors seem to be aware of the original promise of Bitcoin and the biggest cryptocurrency as “selling America” trade gains momentum.

“The connection remains tentative, but it appears that Bitcoin is fulfilling its original promise as a valued unsauvering storage designed to flourish in such an era,” Nydig added.

Read more: Safe shelters of gold and bonds may be in decline with the emergence of Bitcoin