(Bloomberg) – Rugpur. Sniper. I trade “Kabal”. The niche world of Memecoins on the Solana blockchain is at risk for those new to intrigue that suddenly surges and crashes token prices.

Most of them read from Bloomberg

Memecoin Craze, which first appeared organically during Memecoin Craze’s launch two years ago, was recently promoted by famous newcomers including Donald and Melania Trump, as well as Argentine President Javier Milei. This makes the sector feel like an insider marketplace for many in the industry, ensuring the most advantageous trades and allowing retail investors to often bear the brunt of losses.

The first Memecoin was published just a few years after the birth of cryptocurrencies such as Bitcoin, and developers jokingly refurbished popular internet memes. The Solana breakout Memecoin was a Bonk Inu, created after the collapse of the FTX exchange. It was an instant hit in late 2023 as Solana tried to quickly make a profit on a dog-themed token, which was essentially useless but popular.

When launching Memecoin today, it could be on the Solana blockchain. In reality, Solana has become a favourable choice for everything from Libra tokens approved by Mylay, who sparked political controversy, to Trump’s mimecoin to Libra tokens due to the interlocking network of participants behind the creation, release and sale of cryptocurrency.

“The launch of Memecoin was promoted as an antithesis for ‘utilities’ coins that VC Insiders can invest 100 times lower ratings and sell to retailers after launch,” said Jordi Alexander, founder of digital assets trading company Selini Capital. “In fact, there are often insider benefits to launching MemeCoin.”

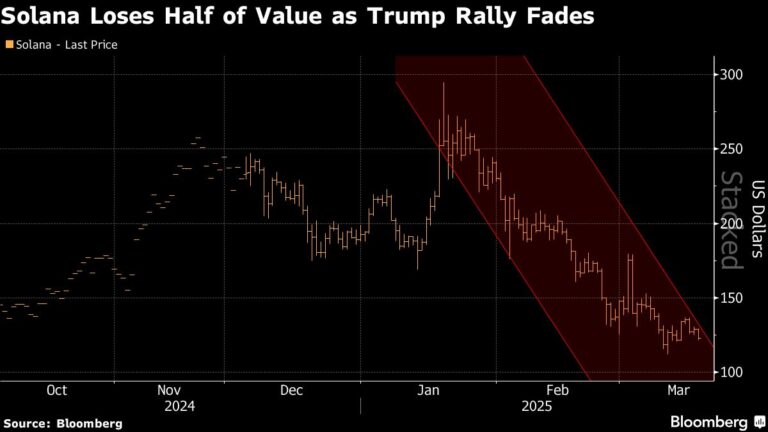

The risks for those who are slower can be easily seen in the Memocoin market. Trump’s Memecoin rose to nearly $74 before taking office, cutting around 85% of its value, according to CoinmarketCap prices. Melania tokens have fallen by about 95% from their highs. Of all the famous losses, the native token sol of the Solana blockchain has lost more than half its value since mid-January.

The most visible participants in the MemeCoin market are participants called Kols, a major opinion leader or a social media influencer with a big following on platforms like X. They are the key to gain recognition in the sea of hundreds of Memecoin that are launched daily after platforms such as pumps.

Kols often invest in tokens with deep discounts before the project is launched in exchange for advertising to followers. According to Mohamed Ezeldin, head of talk nemics for the Animoca brand, Memecoins often claim to embrace a “fair launch” model, but it is rare that all tokens are open to the public.

“Pump and dump”

Dave Portnoy, founder of Barstool Sports, who recently embraced Memecoin Trading, said he was invited to help launch Libra at Xspace on February 16th, including an interview with Milei. Portnoy said he was offered a Libra coin before the launch in exchange for his support, but he said he had not taken any coins. Portnoy did not respond to requests for comment.

Influencers are groups specialized in the creations and often the launch of Memecoin through what Crypto Traders calls “Cabals.” Hayden Davis’s Kelsier Ventures is responsible for launching Libra and falls into this category. According to Joseph Edwards, head of research at Enigma Securities in London, these groups are often heavily involved in manipulating the prices of various memecoin to exploit retail investors.

“We had a variety of market makers who were doing the same thing in 2021: the liquidity of the dark pool,” Edwards said. “They will help launch these tokens, and it will be pump and dump every time.”

Few outsiders knew Davis until he revealed his involvement in Libra in an interview with a YouTube journalist known as Coffee Zilla. He also claimed he was involved with Melania and Enron Memocoin. Other cabals, such as Fantom Groupe and La Vape Cabal, are mostly pseudonyms. Davis did not respond to requests for comment.

One technique used by Cabals is called sniper. This is when the bot uses the bot to buy tokens during launch, selling quickly to capture normal, short-lived price increases. The sniper made infamous during the launch of Trump’s memo coin. A certain digital wallet got tokens at negligible costs before dumping them right after launch, causing prices to crash. Bloomberg reported previously that a wallet that acquired Memocoin at the launch was pre-funded just hours before Trump announced his debut on True Society.

In leaked audio of conversations with Moty Povolotski, co-founder of Crypto Project Defituna, and Ben Chow, co-founder of Solana-based distributed Exchange Meteora, Povolotski said he saw Davis and his family sniper at Enron. Povolotski told Bloomberg the audio was real. Chou did not respond to requests for comment.

Pump.Fun is the most popular platform for launching and trading Memecoins, but Meteora is on a prominent rise. Trump, Melania and Libra were all launched through Meteora. Meteora is part of Jupiter, the broader Solana ecosystem that aggregates token transactions. Jupiter also owns Moonshot, an app that allows users to buy and sell Memecoins via credit cards or Apple Pay. Shortly after Libra’s collapse, Meteora’s Chow said on leak audio that he linked Kelsier Ventures to the Melania Token team.

“With the rise of platforms like Pump.Fun, what people are really allowed to do is focus only on ROI and zoom in on people who aren’t focusing on the basics and utilities,” says Ezeldin of Animoca Brands. “They’re focusing on ‘How can I get in as quickly as possible, how can I get closer to the top?’ By doing so, I created a zero-sum game. ”

“A terrible decline”

Still, the controversy does not seem to cloud the prospects of its members. At the end of February, U.S. Securities and Exchange Commission staff said Memocoin would not be considered a securities. SEC staff compared memokine with collectibles. These focus on limited or unfeasible or lacking functionality, and are often accompanied by statements about risk and lack of utility. As a result, those who offer and sell Memecoin are not required to register with an agent, and buyers are not protected by federal securities laws.

“This message is loud and clear from regulators,” ARK Investment Management CEO Kathy Wood said in a Bloomberg television interview. “There’s a horrific decline in the prices of some of these meme assets, and there’s nothing that people you know will lose money to learn.”

– Support from Emily Nicole and Olga Kharif.

Most of them read from Bloomberg BusinessWeek

©2025 Bloomberg LP