It is certainly unusual for meta transactions to partially acquire AI startup scales to grant ownership of 49%.

The officially announced size is that to value a company with a transaction exceeding $29 billion, and to “distribute” it means to “distribute” it to shareholders, allowing the shareholder (aka employees) to grant it as shareholders to continue as shareholders while granting it “substantial liquidity.”

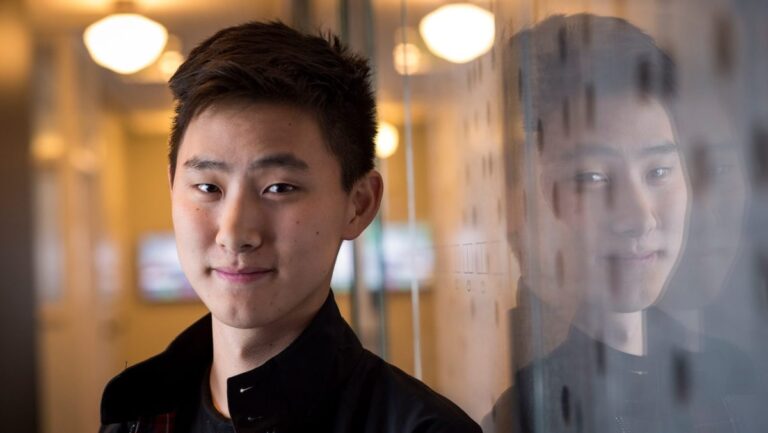

Meta also hires Scale’s well-known founder CEO, Alexandre Wang. He dropped out of MIT at the age of 19 and built a company, providing human-verified AI training data.

This may sound like Meta is buying shares from existing shareholders, but that’s not the case, sources told Bloomberg. Investors are getting dividends, TechCrunch confirmed. For example, Accel, who helped the company early, should receive a $2.5 billion payment, Bloomberg reports. (Accel declined to comment.)

Scale has dozens of backers, including Amazon and Meta, and was worth $14 billion in the end after raising a $1 billion series a year ago. So paying dividends of this magnitude is like buying a company. You will need to wait for regulators to agree.