Moody’s ratings down the US sovereign credit rating from the highest possible AAA to AA1, citing the burden of funding the federal government’s fiscal deficit and the rising costs of carrying forward existing debt amid high interest rates.

“This one record downgrade on the 21 Notch rating scale reflects a decade-long increase in government debt and interest payment rates to levels significantly higher than similarly rated sovereigns,” the valuation agency said in a statement.

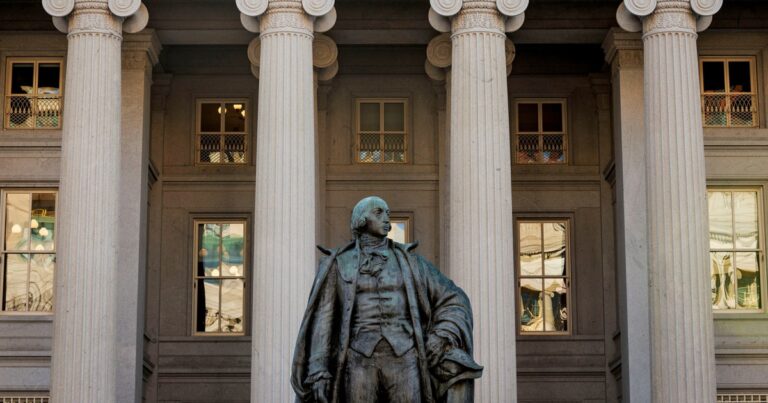

The decision to lower the US credit profile is expected to raise the yields investors demand to buy US Treasury debt to reflect more risk, and could undermine feelings about owning US assets, including stocks. That said, all major credit rating agencies continue to give the US the second highest available rating.

Benchmark 10-year Treasury yields were 3 basis points in after-hours trading, trading at 4.48%. iShares Treasury bond ETFs for over 20 years fell by about 1% in extended transactions, while SPDR S&P 500 ETF Trust fell by 0.4%.

Moody’s was a holdout to keep our sovereign debt at the highest possible credit rating, matching the 116-year-old agency with its rivals. Standard & Poor’s downgraded the US from AAA to AA+ in August 2011, and Fitch Ratings reduced the US rating from AAA to AA+ in August 2023.

“All US administrations and Congress have not agreed to measures to reverse the trend of massive annual fiscal deficits and interest growth,” Moody analysts said in a statement. “We don’t believe that multi-year reductions in mandatory spending and deficit material will arise from being based on current fiscal proposals.”

Large deficit

The US has a massive fiscal deficit as interest costs on Treasury debt continue to rise and the combination of key debts to finance continues to rise. The fiscal deficit for the year that began on October 1st was already operating at $1.05 trillion, up 13% from a year ago. Revenue from tariffs helped shave some of the imbalances last month.

The Moody downgrade came as the GOP-led House Budget Committee on Friday rejected a drastic tax cut package as part of President Donald Trump’s agenda, including extending the tax cuts enacted in 2017.

Moody’s first officially evaluated US bonds in 1993, but since 1949, it had assigned the AAA “national ceiling rating” in the US.

-Includes additional reports from CNBC’s Christina Cheddar-Berk and Scott Schnipper