(Bloomberg) — MicroStrategy Inc. has bought $1.1 billion in Bitcoin as it prepares for a shareholder vote on a 30-fold increase in its outstanding Class A shares.

Most Read Articles on Bloomberg

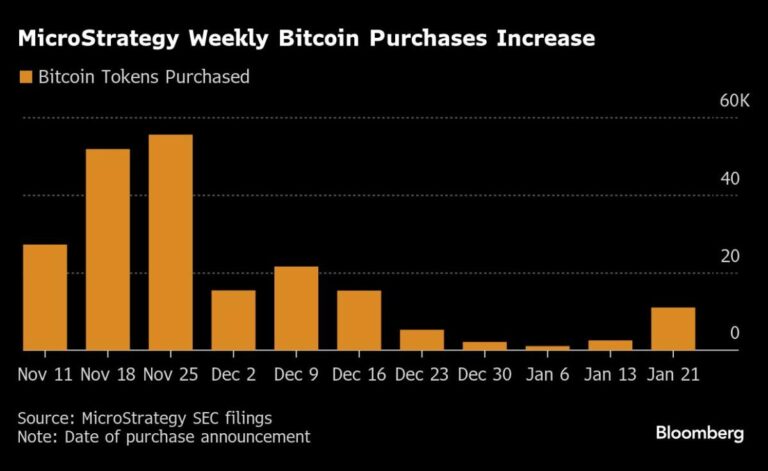

This marks the 11th consecutive week of token purchases for the enterprise software company turned leveraged Bitcoin proxy. Co-founder and Chairman Michael Saylor has ramped up his purchases of the original cryptocurrency, and the Tysons Corner, Virginia-based company now owns more than 2% of all Bitcoin that will ever exist. There is.

MicroStrategy purchased 11,000 Bitcoin tokens from January 13 to January 20 at an average price of approximately $101,191, according to a filing with the Securities and Exchange Commission. It holds approximately $47.9 billion in Bitcoin.

The company has been financing its Bitcoin purchases through stock sales on the market and the issuance of convertible bonds. MicroStrategy plans to raise $42 billion in funding by 2027 from these services.

Hedge funds are driving some of the demand as they seek out MicroStrategy, a convertible arbitrage strategy that involves buying bonds and shorting stocks, essentially betting on the volatility of the underlying stock.

MicroStrategy has accelerated its capital goals and Bitcoin purchases since the election of President Donald Trump, a crypto skeptic turned industry supporter who said his administration would create a more crypto-friendly regulatory environment. It is expected. Prior to President Trump’s inauguration, Saylor attended the Crypto Ball in Washington, where he met with some of the president’s incoming cabinet members and his family, according to a post by X.

MicroStrategy shareholders will vote on Tuesday on whether to increase the number of Class A common stock issuable from 330 million shares to 10.3 billion, and whether to increase the authorized number of preferred stock from 5 million shares to 1 billion shares. Saylor holds about 47% of the voting rights and the amendment is expected to pass.

The so-called Bitcoin treasury company currently has about $5.42 billion of outstanding shares outstanding under its capital plan. As stock sales increase, MicroStrategy can continue to fund additional Bitcoin purchases.

MicroStrategy stock closed at $396.50 on Friday, up 37% since the beginning of the year.

story continues