As wildfires continue to wreak havoc in California’s Los Angeles County, all eyes are on how the tens of thousands of people directly affected by the fires will recover what they lost, and the potential insurance storm that awaits them. are gathering.

Thousands of properties have been damaged or destroyed, and owners are unsure whether they will be covered by insurance. The ongoing fires could be the most expensive insured losses in California’s history, with analysts estimating that damages could reach $20 billion.

Here’s what you need to know:

How much damage have wildfires caused so far?

At least 27 people died in the wildfire.

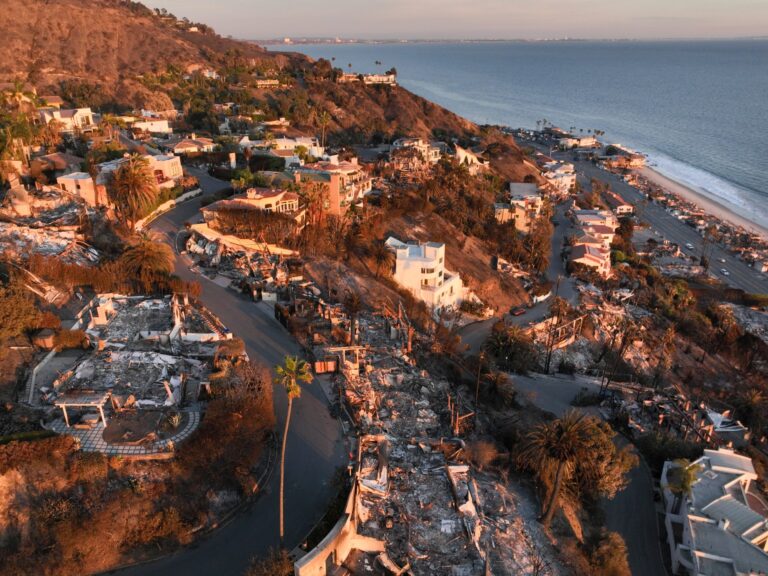

The first wildfire in the Pacific Palisades burned 9,596 hectares (23,713 acres), according to the California Department of Forestry and Fire Protection (Cal Fire). More than 12,300 homes and structures were destroyed.

There are two fires burning in Los Angeles County. The Palisades fire is 27% contained and Eaton is 55% contained.

How much did the LA fire cost?

Analysts predict, based on preliminary estimates, that the LA wildfire could become California’s costliest wildfire in terms of insured losses, possibly exceeding $20 billion. An insured loss is an economic loss caused by an insured event.

Private forecasting firm AccuWeather estimates that total damage and economic losses will be between $250 billion and $275 billion, making the Los Angeles fires the costliest natural disaster in U.S. history, surpassing Hurricane Katrina in 2005.

To date, the most expensive wildfire in terms of insured losses was the 2018 Camp Fire in Northern California’s Butte County, which caused total losses of $12.76 billion.

Historically, the most expensive natural disasters in terms of insured losses are hurricanes and earthquakes in the United States. Insured losses from Hurricane Katrina totaled $105 billion.

What did insurance companies do before the wildfires?

Before the fires broke out, insurance groups like State Farm and Allstate began canceling home insurance policies in fire-prone areas.

As of 2022, Illinois-based State Farm was California’s largest insurance company.

In July 2024, the company terminated approximately 1,600 insurance policies for Pacific Palisades homeowners. This means 69.4 percent of insurance policies in the county were not renewed.

From 2020 to 2022, insurers did not renew the policies of 2.8 million homeowners in California. More than 500,000 of those cases were in Los Angeles, according to the California Department of Insurance.

“There’s a huge exodus of large companies from the market in these parts of California,” Ben Keyes, a real estate and finance professor at the Wharton School at the University of Pennsylvania, said at a conference Friday.

“We’ve been seeing a lot of non-updates lately,” he said.

David Flandro, head of industry analysis and strategic advisory at global reinsurance broker Howden Re, said the size and scope of the wildfires could be a cause for concern.

“Unfortunately, the reporting system may not be set up to cover everyone,” he told Al Jazeera.

Why did State Farm cancel my insurance?

In May 2023, State Farm issued a statement saying it would no longer accept new applications, including commercial and personal property and casualty insurance. The statement added that this was due to “historically rising construction costs that outpace inflation, rapidly increasing catastrophe risks, and a challenging reinsurance market.”

Brooklyn reporter Jake Bittle told the PBS Network that the reason State Farm and other insurance companies have terminated or limited insurance policies in California is because “California has limited the amount that insurers can charge customers. He said this was because he was restricting the number of people.

In 1988, California passed a general election ballot measure called Proposition 103, or the Insurance Rate Reduction and Reform Act.

The proposal lowered premium rates and established a pre-approval system under which insurers must obtain approval from the California Insurance Commissioner before implementing property and casualty premium rates.

However, these approvals take time. California’s system has always been slow, and it’s getting slower. From 2013 to 2019, homeowners insurance rate applications took an average of 157 days from submission to resolution. This increased to an average of 293 days between 2020 and 2022.

California law requires insurance companies to justify their rates for catastrophe-related losses based on average catastrophe losses over the past 20 years.

Regarding California wildfires, insurers argue that future predictions based on past losses will be inaccurate because the fires are unpredictable and more destructive than in the past.

From 2004 to 2013, California wildfires destroyed an average of approximately 653 structures each year. But from 2014 to 2023, California wildfires destroyed an average of about 5,669 structures each year. This average was increased by the devastating fires of 2017, 2018, and 2020.

In 2017, the Thomas Fire destroyed 1,060 structures in Ventura and Santa Barbara, California. In July 2018, the Mendocino Complex Fire destroyed 280 buildings in Mendocino, Lake, Colusa, and Glenn counties, and in November 2018, the Camp Fire destroyed approximately 19,000 buildings in Northern California’s Butte County. .

Proposition 103 “contributed to the challenges” facing California’s insurance market, Ray Lehman, a senior fellow at the Center for International Law and Economics, an independent research organization, told Al Jazeera.

Most notable among these challenges, Lehman said, is that the proposal would “require insurers to take into account the cost of reinsurance and the output of forward-looking catastrophe models when reporting interest rates. “historically has not been recognized,” he said.

“This effectively means that states are not allowing insurance companies to consider the effects of climate change, or that future losses could be much larger than past losses.”

Amid the devastation, insurance companies “lost decades of underwriting profits” and “became convinced they couldn’t make enough money doing business in California,” Bittle told PBS. . This also contributed to companies leaving California, he explained.

What did the homeowner do about this?

A state-funded plan called the California FAIR Plan (Fair Access to Insurance Requirements) was established in 1968 to cover some homeowners who, for various reasons, cannot afford standard home insurance. Some people choose insurance programs that are

The FAIR plan is funded by private companies rather than taxpayer money and was originally devised to distribute a limited number of insurance policies to people without standard insurance. As of 2024, 452,000 Californians are enrolled in FAIR plans. However, this plan only provides basic coverage up to $3 million, which may not be enough to completely rebuild some homes.

According to the U.S. Census Bureau website, as of July 2023, California will have nearly 15 million housing units, and as of July 2024, California’s population will be nearly 40 million.

FAIR plans are more expensive than regular insurance. The average annual cost of FAIR Plan insurance in California was about $3,200, according to a December 2024 memo from New York-based financial services firm Bankrate.

Meanwhile, the average home insurance policy in California costs $1,480 for a $300,000 home insurance policy, according to Bankrate.

As a result, hundreds of thousands of homeowners in California do not have property insurance.

A report released Jan. 9 by online marketplace LendingTree estimates that 806,651 of California’s 7.6 million homes are uninsured. LendingTree estimates that 154,108 of Los Angeles’ 1.5 million homes are uninsured, meaning 1 in 10 homes in the county is uninsured.

Still, as private insurers left California, “the number of state insurers offering FAIR plans of last resort has grown exponentially,” Lehman said.

In fact, as private insurers exited, FAIR plan exposure increased dramatically, increasing by 61.3% during September 2023 to $458 billion in September 2024. FAIR has $5.9 billion exposure to Pacific Palisades.

Is the climate crisis an insurance crisis?

Wildfires are one of the environmental disasters that will intensify as climate change looms over the planet.

A report from the U.S. Environmental Protection Agency (EPA) says climate change is contributing to an increase in the frequency, length of seasons, and area burned by wildfires. California’s wildfires have traditionally been limited to certain months, but the state’s governor, Gavin Newsom, recently said California is no longer in “season” for fires.

“It’s hot all year round in California,” Newsom said in a video posted to his X account on January 8.

Research shows that the insurance industry is ill-prepared to pay the price of the climate crisis.

In 2024, a report by campaign group Insure Our Future found that climate change was responsible for a third of all weather-related insurance losses worldwide over the past 20 years.

“The California Department of Insurance is doing the right thing by promulgating new rules that allow insurance companies that agree to do significant business in areas exposed to wildfires to consider catastrophe models and reinsurance costs. “It’s a step in that direction,” Lehman said. .

He added that state leaders should consider making significant investments in wildfire mitigation “to ensure that California is insured for the future.” This could mean “changing building codes, allowing utilities to invest in underground power lines, or rethinking land use planning and zoning at the wildland-urban interface.”

Can businesses cover losses through insurance?

Despite the high cost of damages, experts believe that insurance companies will have no problem compensating their customers.

“Insurance companies that sell homeowners insurance in California are generally financially sound and should not face serious solvency concerns,” Lehman said.

A report from Standard & Poor’s says insurers will start 2025 with strong reserves thanks to strong financial results over the past two years.

JPMorgan analysts asserted that under current conditions, they expect “the majority of wildfire losses to be concentrated in homeowners insurance,” with commercial and personal vehicle losses expected to be “significantly lower.” .

However, Lehman added, “The Palisades fire had a disproportionate impact on very expensive properties, many of which are likely to be compensated through wealthy individuals.”