(Bloomberg) – The Gold Rally surpasses other asset classes this month – even portraying a comparison with Bitcoin – President Donald Trump’s tariff war has re-changed the global economic order and urged investors to look for safety. Now there are market watchers who say it’s time to be cautious about shifting options placement.

Most of them read from Bloomberg

With bullion hitting record last week, trading options for SPDR Gold stocks exceeded 1.3 million contracts, at a level never before reached. At the same time, hedging costs against a decline in funds trading on exchanges are approaching its lowest level since August, but with implicit volatility surges and unusual patterns surge.

“We are pleased to announce that Tanvir Sandhu, Chief Global Derivative Strategist at Bloomberg Intelligence,” said: Although demand for metal calls has skyrocketed, he added that recent assets declines have made the implicit volatility of the entire strike more balanced.

Also Read: Strategists Called Exceptionism That Called Our End No Recovery

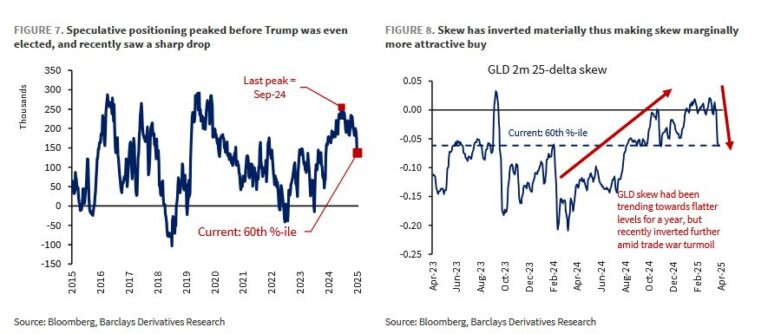

Gold lost more than 6% last week from its daytime peak last week on signs that trade tensions may be eased. Meanwhile, hedge fund managers have reduced net long futures and options positions on metals to the lowest levels for over a year, the latest Commodity Futures Trading Commission data show.

Catalyzed by tariffs and led by the theme of ending “US exceptionalism,” the recent risk-off period helped gold outperform more this month than the Treasury Department and other asset classes, including US stocks.

But for Barclays PLC strategists, metal runs ahead of its basics. In a memo last week, they noted that recent monthly gold purchase streaks are not unusual compared to the long-term trends of central banks buying assets.

Outperformance also brought significant speculation, with the gold ETF call surge after Trump’s “liberation day,” leading to a skew reversal, noting Barclays’ Stefano Pascal. That’s why, along with a decline in hedge fund positioning and a recent decline in bullion, there is a reason to be cautious, at least in the short term, the strategist said.

“I think the money will fall,” Pascare said in an interview, adding that the product is “dislocated” in terms of “basic drivers” and real interest rates for the US dollar. “My technology is beginning to grow a little.”

The story continues