The “big, beautiful bill” for the United States Republican is a broad tax and spending law, and is at a critical moment.

The nearly 400-page law proposes drastic changes, including an extension of the 2017 tax cuts, reducing taxes for businesses and individuals, and enacting deep cuts to social programs such as Medicaid and SNAP.

While Republicans are touting the bill as a boon to economic growth and middle class relief, nonpartisan analysts warn that it can add trillions to national debt and take millions of Americans out of medical and food aid Americans.

The bill will be voted today by the House Budget Committee and, if passed, will be voted on the floor next week.

The most substantial part of the bill is the extension of the 2017 tax cut. The tax bill will add at least $2.5 trillion to the national deficit over the next decade, reducing federal tax revenues by 2034.

Passing the law will raise the debt cap and set the amount the government can borrow to pay for existing expenditures.

Below are some of the key measures of the proposed bill in its current form.

Changes to households

The bill increases the standard deduction for all Americans. Individual deductions increase by $1,000, $1,500 for heads of households, and $2,000 for married couples.

The bill would have extended the child tax credit by $2,000 or else it would have ended at the end of the year 2017 tax cut.

This tax year will increase the child tax credit at $500 per child, and will continue until the end of 2028. It also includes a $1,000 savings account for children born between December 31, 2024 and January 1, 2029. The law allows families to offer tax-free $5,000 a year.

Americans over the age of 65 will receive a new tax credit. The new bill will offer an annual deduction of $4,000 starting this year to earn $75,000 per person and $150,000 for married couples this year. If passed, the rules will take effect for the current tax year and will run until the end of 2028.

“When many of these things eventually expire, they only make tax payments more complicated and more uncertain,” Adam Michel, director of tax policy research at the Right Foot Cato Institute, told Al Jazeera.

Another provision in the bill amends the state and local tax (salt) deduction. This allows filers to amortize some of what they pay in local and state taxes from federal filings.

Under the 2017 tax law, it was limited to $10,000, but the new law will raise it to $30,000. Some Republicans, especially Republicans in states with higher taxes like New York and California, are asking for the cap to be raised or the cap is removed entirely. But they face the Finance Hawks and those who are already considered relief for the wealthy.

The bill includes an increase in profits for small businesses that can deduct 23% of eligible business revenues from taxes, up from the current 20%.

There is also a call for no tax on overtime payments for selected individuals. It does not apply to people who are non-citizens, those considered “highly compensated employees,” and those who earned wages.

But the bill also eliminates taxes on tips, a key campaign promise by both Donald Trump and his democratic rival Kamala Harris. The bill would allow people who work in sectors such as food service, hair care, nail care, aesthetics, and body and spa treatments to specifically deduct the amount of income they tend to receive.

At the federal level, employers don’t have to pay advanced workers more than the $2.13 hourly submarine wage. The intent is that it can make up for the difference in workers’ tilting receipts from customers.

Reduction to social safety nets

The law calls for major government programs to cut $880 billion, focusing primarily on Medicaid and food stamps.

The CBO has discovered that over 10 million people could lose access to Medicaid, and that 7.6 million could lose access to health insurance completely by 2034 under their current plans.

Even far-right Republicans are calling for Medicaid cuts. In operation by the New York Times this week, Missouri Republican Sen. Josh Hawley said Cutt was “morally wrong and politically committed suicide.”

A new report from one fair wage shared with Al Jazeera shows that 1.2 million restaurants and cutting-edge workers could lose access to Medicaid, so hinted workers could be hit particularly hard.

“There is no tax on hint proposals. This is like a small percentage of income and does not affect two-thirds of hint workers because they don’t earn enough income to pay federal income taxes. It’s not enough place to compensate for these workers’ lack of ability to care for themselves. The workers told Al Jazeera.

The bill also introduces work requirements to receive benefits, saying that recipients must prove they are working, volunteer and be enrolled in school for more than 80 hours a month.

At the same time, the bill will also shorten the open enrollment period for the Affordable Care Act (ACA) in one month (ACA). This means that employer-funded people who lose their jobs may be unqualified to purchase private plans in a healthcare exchange.

“It takes 11-12 weeks of people to find a new job. The worse the labor market is, the more sick the number will feel. If you’ve been unemployed for three months, if you’ve driven Medicaid away, you can get rid of Medicaid.”

“And then, when I tried to buy a plan from the ACA Marketplace, I lost my qualifying for the grant. I think this is really cruel.”

Other major proposed cuts will hit programs such as the Supplementary Nutrition Assistance Program and SNAP. This comes when 42 million low-income people provide food, and food costs are 2% higher than a year ago. The CBO has discovered that 3 million people could lose snap access under the new plan.

The bill also forces states to hold more responsibility in funding the program. States must cover 75% of their administrative expenses, and all states must pay at least 5% of their benefits. 28 states need to pay 25%.

“Currently, the state will be hooking for billions of dollars to fund these two important programs. They have made a tough choice. One is to cut funding from others like K-12 education, roads, veteran services, and allow them to raise more revenue to cover this gap or cover this gap,” Pancotti added.

Under current law, the federal government is solely responsible for being in charge of the costs of benefits. The proposed cuts would save $300 million for the federal government, but would hit the state’s budget hard.

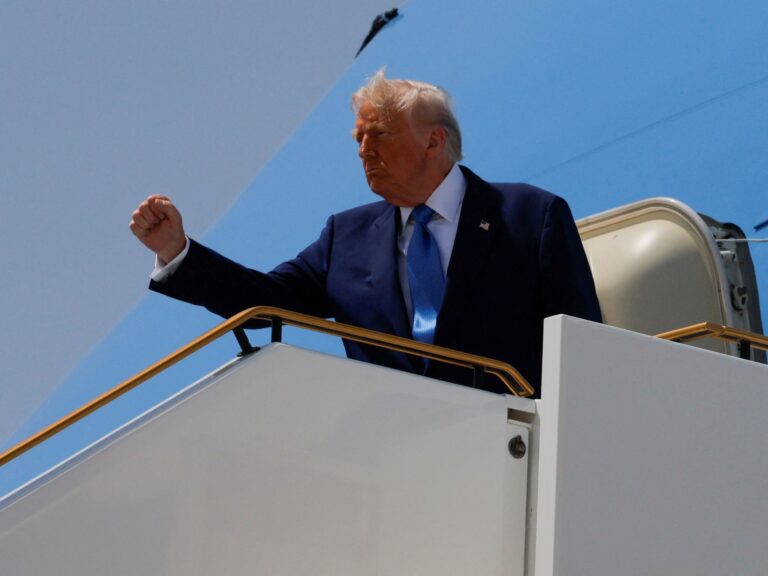

Bill burns Trump administration priorities

The bill would also cut $7,500 in tax credits and $4,000 in second-hand EVs for purchasing new electric vehicles.

Last year, General Motors sent billions of dollars into domestic EV production. This includes a $900 million investment to remodel existing plants to build electric vehicles in Michigan, and alongside Samsung, the automaker has invested $3.5 billion in US EV battery manufacturing.

In February, Ford CEO Jim Farley said that revoking the EV tax credit could put factory work in the chopping block. The automaker has invested in three EV battery plants in Michigan, Kentucky and Tennessee. The federal government, under the control of former President Joe Biden, paid more than $2 billion in EV tax credits in 2024.

The proposed law also gives Trump administration officials the tax-free status of nonprofit organizations it considers as “terrorist aid organizations.” It gives Treasury secretaries the ability to condemn nonprofits that support “terrorism” and the ability to revoke their tax-free status without allowing legitimate procedures to prove that they have raised serious concerns among critics.

“The true intentions of this measure lurk behind hyperbolic and unfounded terrorist anti-rhetoric, allowing the Treasury to explicitly target, harass and investigate the thousands of American organizations that make up civil society, including non-profit newsrooms.”

“The language of the bill lacks meaningful safeguards against abuse. Instead, it carries the burden of proof on the organization rather than the government. It’s not difficult to imagine how the Trump administration would use it to revenge on a group that has questioned or simply angered the president or other officials.”

The bill will introduce new taxes to universities, including various tax rates based on the size of contributions per university student. The highest student tax rate in the university is 14%, exceeding $125 million per person, and under 21%, over $2 million or more, under 21%.

This is happening amid growing tensions in the Trump administration with higher education. Last week, the Trump administration pulled out $450 million in Harvard grants, in addition to the $2.2 billion it pulled in April. This is a move that hampers cancer and heart disease research, among other regions. Harvard has a donation of $53.2 billion, making it one of the richest schools in the country.

The law would also increase funding for the border wall between the United States and Mexico. The administration argued that it would help to curb undocumented immigration. However, there is no evidence that such a wall blocked the border crossing.

A 2018 analysis from Stanford University found that border walls only suppress 0.6% of travel, but the bill would give more than $50 billion to complete the border wall and maritime intersection. The bill also provides $45 billion in transportation for the construction and maintenance of detention facilities, as well as an additional $14 billion in transportation.