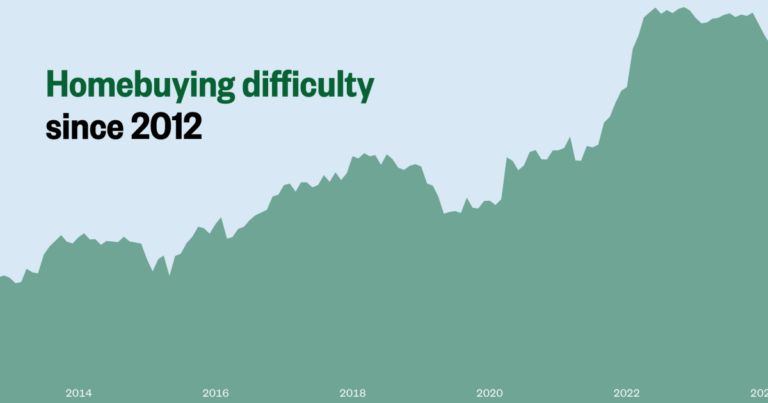

Why is it so difficult to buy a house? The price is far higher than the middle class income. The mortgage fee has been over 7 % since 2002. Three out of 10 houses are sold beyond listed.

However, none of these factors have completely captured the various issues facing the current market nationwide. The conditions on the ground may vary greatly depending on the state and county lines.

In order to know how the housing market changes at the regional level, we will introduce NBC News Home Buyer Index as much as possible as close as possible.

NBC NEWS has been developed under the guidance of an analyst in the real estate industry, a real estate professional, a real estate expert in the Federal Reserve of Atlanta and other expert A face that is about to buy a house. The higher the index value, the higher the difficulty.

For example, 10 low index values suggest that buyers’ better purchases, low interest rates, and sufficient housing sales. Chembers County, Texas, near Houston, is one of the most difficult places to buy in Japan as of May, and has a low score on rarity, cost and competition.

The value close to 90 suggests a very strict condition. This can be caused by intense bidding, high insurance expenses, or a steep jumping of housing prices than in income. As of May, as of May, it is one of the most difficult counties to buy a house as of May, as the price is rising rapidly in Coconino County, Arizona. Five years ago, it was ranked 300, but the median selling price increased 81 %, almost twice the number of people nationwide.

The index is a county that has enough housing purchase data to evaluate information, and measures the national difficulty at the county level.

The following national indexes capture large selected markets and economic conditions that affect housing in the United States.

This index consists of four factors.

Cost: Housing expenses related to income and inflation cost, as well as how related expenses such as insurance expenses have changed. Competition: Number of people fighting home -and how aggressive the demand is. This is measured through the percentage of houses sold beyond the list price and the number of contracts within two weeks after being listed. Rare: Number of houses on the market -and many people who are expected to enter the market next month. Economic instability: Market volatility, unemployment rate, interest rates -Reflections of a wider area that shoppers at home are considering making decisions.

In December, the Index for the National Home Buyer was 81.5, exceeding half the points from November, and this time two points lower than a year ago.

With the improvement of market competitiveness, conditions have been slightly eased within the past year. However, due to high cost and continuous shortage of housing, we maintain the overall difficulty of buying a house.

The index is updated every month on the last Thursday of the month. The next update is February 27.