Bosch’s venture arm has a new $270 million fund that continues its tradition of investing in deep tech startups. However, this time, Bosch Ventures plans to put more money into North American startups.

Started in 2007, Bosch Ventures is currently on its sixth fund. Additionally, while corporate VCs are technically global companies, their focus today is heavier on North America.

The strategy may seem contradictory given this, given that it is an area affected by US trade war with China, volatile stock markets and US administrative policies that have led to fears of a recession. But Ingo Ramesohl, managing director at Bosch Ventures, told TechCrunch that North American trading flows are stronger than ever.

“I see a lot of positive energy,” said Lamesor. “People aren’t stopping innovation and not trying to stop getting confused, so for me, it’s really a great time for new investments.”

With offices in Silicon Valley, Boston, Germany, Tel Aviv and China, the company typically invests between $5 million and $10 million. Ramesohl said he is likely to make 20-25 investments from the fund.

“This is basically a continuation of the last funding success story,” Lamesor said.

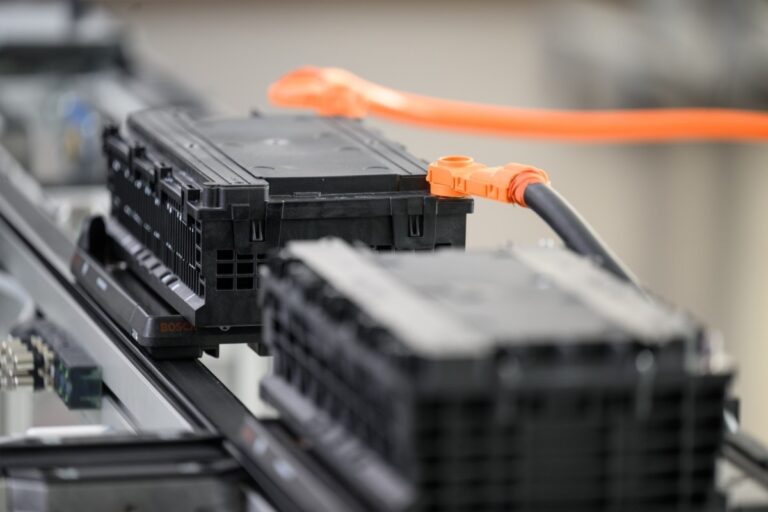

The company continues to invest in automotive, climate technology, cybersecurity, semiconductor manufacturing, energy efficiency and enterprise software. Generator AI is also listed, more specifically applying AI tools to the physical world, such as manufacturing.

TechCrunch Events

Berkeley, California

|

June 5th

Book now

“We’re not entirely focused on genai,” says Ramesohl.

Still, AI has been a central manufacturer since its establishment in Bosch’s AI Center at least in 2017. The company says Ramesohl has confirmed that all Bosch products are currently being developed or produced using AI, a milestone that hit at the end of 2023.

“genai is changing a lot, and at the same time it allows for many new businesses, many new innovations,” he said.