(Bloomberg) – BlackRock Inc., the world’s largest asset manager, is launching Bitcoin exchanged goods in Europe following the success of a $48 billion US fund tracking cryptocurrency.

Most of them read from Bloomberg

iShares Bitcoin ETP will list Xetra and EuroNext Paris under the ticker IB1T on Tuesday, and EuroNext Amsterdam under the BTCN, the company said in a statement. This product debuts with a temporary fee waiver of 10 basis points. This will reduce the expense ratio to 0.15% until the end of the year.

European instruments are BlackRock’s first foray into crypto-related ETPs outside of North America. Bloomberg News previously reported BlackRock’s plans.

“It reflects what we really see as a turning point for the industry. The combination of established demand from retail investors and demand with more experts is now really folded,” said Manuela Sperundeo, head of Europe at BlackRock and head of Middle East isharas products, about the product launch in an interview.

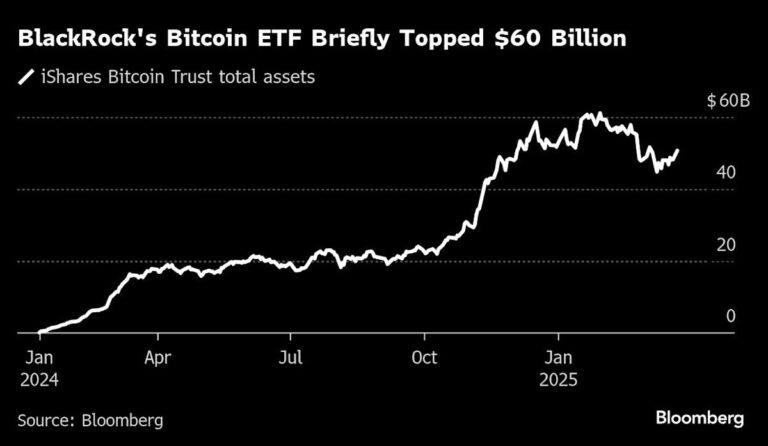

BlackRock’s US-listed ISHARES Bitcoin Trust debuted in Great Fanfare last January, quickly gathering billions of dollars in assets and recording the highest launch of the Exchange Sales Fund in market history. Cryptocurrency-linked ETPs have been traded in Basene, Europe for many years, but the market’s $13.6 billion size pales in comparison to that in the US.

A fee waiver means that the IB1T will be the cheapest on the market at launch. Coinshares International Ltd, Europe’s largest Crypto ETP, costs $1.3 billion physical Bitcoin products, charge 0.25%. This is the same as BlackRock’s IB1T once the waiver period has expired.

Crypto Exchange Coinbase Global Inc. will detain physical Bitcoin in favour of the product, BlackRock said. Open to both institutional and informed retail investors, the IB1T is issued by special purpose vehicles residing in Switzerland.

– Support from Sidarta Shukla.

(Add chart)

Most of them read from Bloomberg BusinessWeek

©2025 Bloomberg LP