The equity and crypto market mood went sour late Tuesday, with NVIDIA crashing in after-hours trading following a $5.5 billion charge linked to the Trump administration’s decision to ban the company’s H20 chip sales in China.

Bitcoin, the leading cryptocurrency by market value, fell to $83,600, expanding its withdrawal of $86,440 from its two-week high, early in the day, Coindesk data showed. Payment-focused XRP followed a similar trajectory, surpassing 2% to $2.08, while Cardano’s Ada Token reduced its 4% to $0.61. The broader market gauge, the Coindesk 20 index, has weakened by more than 2%.

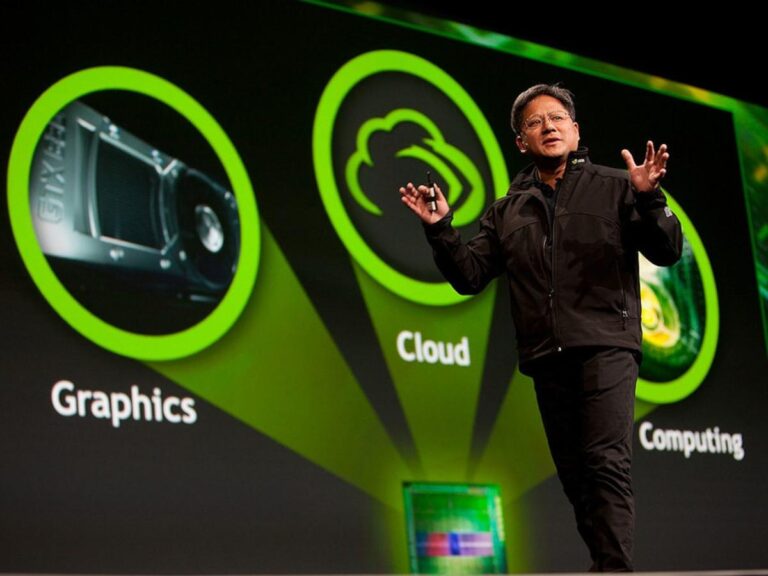

Meanwhile, the coin, which appears to be linked to artificial intelligence (AI), has raised 8% to $89.10 after the company disclosed in a regulatory filing that NVDA stocks are planning to write down $5.5 billion in the first quarter due to new restrictions on H20 chip exports to China.

The news came a day after an unusual activity in the NVDA placed an option pointing to an imminent market.

Futures related to the Nasdaq index also fell by more than 1%, providing negative cues to risky assets in general.

The next Catalyst, waiting for the Eastern Time release on Wednesday morning, is its US retail sales report for March. For each economist voted by Dow Jones, the data is expected to show a 1.2% increase in consumer spending that month, up from a 0.2% increase in February.

The more than expected report could help ease the fear of the recession caused by President Donald Trump’s trade war with China and other trading partners. However, there is a risk that the market will make it appear backwards and will not be able to explain the major escalation of trade tensions seen this month.

Federal Reserve Chairman Jerome Powell will also speak on the outlook for the US economy at the Chicago Economic Club on Wednesday.

“Every eye is on Powell. The market is holding its breath for Powell on Wednesday. During the increasing trade war and recession challenges, traders are seeing tips that the Fed may be forced to cut faster than expected.”

Future-proof market-based measures like inflation breakevens have fallen amid trade tensions, pointing to the non-shocking effects of Trump’s tariffs. It could provide the Fed with room to cut fees.

Earlier this week, Federal Reserve Gov. Christopher Waller said if the US president reimposes taxes announced on April 2, banks will be forced to cut a series of “bad news” rates.

Read more: Bitcoin will whiver for $85,000 for $85K, just as Fed Waller suggests reducing the “bad news” rate.