Bitcoin’s rapid price rally has made traders gross and caused a massive liquidation of bearish short positions.

Major cryptocurrencies by market value have grown by more than 3% in the last 24 hours to $102,500, with the highest price since January 31st at $104,000. President Donald Trump has appeared in funds (ETFS) that have announced a comprehensive trade agreement with the UK and imposed a cumulative exchange.

According to the data source TradingView, the total market capitalization of all coins except BTC increased by 10% to $1.14 trillion, and the broader market has also recovered.

It led to a substantial liquidation of bearish short positions, or leveraged plays aimed at profiting from price losses. When a trader’s account balance falls below the required margin level, positions are often liquidated or forcedly closed due to unfavorable price movements. This allows the exchange to close the position and automatically prevent further losses.

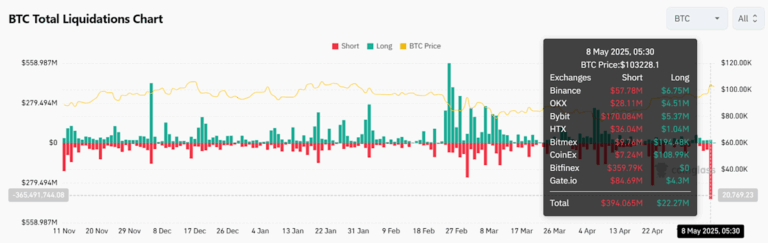

Nearly $400 million in the BTC short position has been liquidated in the last 24 hours, according to Coinglas. Meanwhile, the long position of $22 million has also been wiped out.

This important imbalance indicates that leverage is leaning heavily towards the bearish side, suggesting that a rapid liquidation of shorts could potentially be a more upward trend in the future market.