The bullish Bitcoin (BTC) option strategy has once again gained popularity, stabilizing key emotional indicators of panic earlier last week.

BTC has bounced over $84,000 since it surveyed its lows below $75,000 last week. The recovery appears to have forced the bond market turmoil to force President Donald Trump to surrender to tariffs just days after he wiped out import taxes in several countries, including China.

Late Friday, the Trump administration issued new guidelines, saving key technology products such as smartphones from his 125% Chinese tariffs and a global collection of 10% baseline. Hours later, Trump rebutted the news, suggesting there was no tariff relief.

Still, the price recovery has led to the brave trader upside down in BTC through call options registered with DeLibit. The phone grants the buyer the rights, but there is no obligation to purchase the underlying assets at a given price before a certain date. Cole buyers are implicitly bullish in the market, aiming to profit from the expected price rise. Put buyers are said to be bearish and are seeking hedges or profits from price surges.

“Trump’s Bond Market Crisis Fuel Fuel Refill has spoken out to markets from aggression to surrender and fueled by markets from offensive bounce. Update.

Data tracked by Amberdata, earlier last week normalized skew with options that reflect strong Put bias or downside fear normalized skew. Skew measures the implicit volatility (demand) of calls on puts and has been a reliable indicator of market sentiment for many years.

The 30, 60 and 90-day skew rebounded slightly above zero from the deep negative level a week ago, indicating a decline in market panic and a revival of upside-down interest. The gauge remains negative for the seven-day period, but reflects a more pronounced Put Bias than a week ago, when it fell to -14% a week ago.

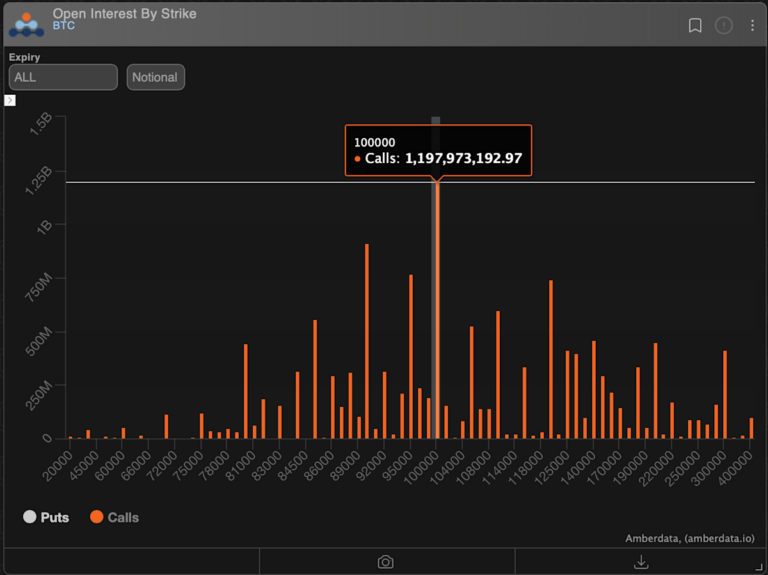

Another data point that could stimulate recently abused market participants is the distribution of open interest, highlighting the revival of $10,000 calls as the most preferred option for Delibit, which accounts for more than 75% of global option activity.

At the time of writing, the $10,000 call boasted a cumulative concept public profit of nearly $1.2 billion. The expected value represents the US dollar value of the number of active option contracts at a given time. Earlier this year, the $100k and $120,000 phones were popular, but the market was able to deploy the money to the $80k that was last month.