Bitcoin (BTC) rose very gently on Monday as the broader markets were tuned favorably with trade-related news.

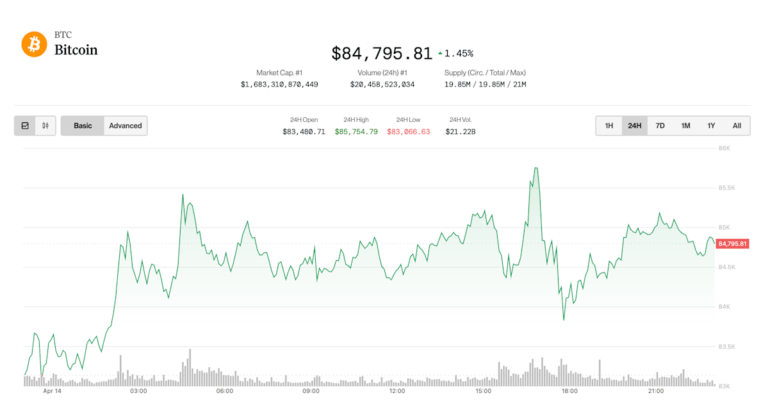

The biggest cryptocurrency has grown by 1.6% in the last 24 hours and is currently trading at $85,000 shy. Meanwhile, Ether (ETH) rose 2.7% to $1,630 over the same period. The Coindesk 20 index, which has a major market, consisted of the top 20 cryptocurrencies by market capitalization, with the exception of Stablecoins, Memecoin and Exchange Coins, led by Sol and Avax profits.

A few weeks after the wild, the stock market was also higher than today, with the Nasdaq shutting down at a gain of 0.6%, and the S&P 500 gaining 0.8%. Strategy (MSTR) and Mara Holdings (Mara) lead among crypto stocks, earning around 3%.

The modest rally showed that Federal Reserve Gov. Christopher Waller suggested that the original punitive Trump tariff return would create a need for a substantial “bad news” rate reduction.

“The impact on (customer tariffs) production and employment can last long and can be a key factor in determining the right attitude in monetary policy,” Waller said in his speech. “If slowing is important and even threatens a recession, I hope that we will prefer to cut FOMC policy rates faster and significantly more than we previously thought.”

Further relaxed concerns confirmed that the European Commission, the EU’s executive arm, will “allow space for negotiations” until July 14th, with the retaliation fees for US goods worth 21 billion euros.

There is a chance that the US and the EU will reach a trade agreement to avoid tariffs in the multi-tiered blockchain-based forecast market after US President Donald Trump says the deal is ongoing.

The Bitcoin relief rally from last week’s tariff disruption was stagnant at a $85,000 resistance level, but the network’s improved fundamentals hope for a breakout.

“Since March, we’ve seen a consistent influx of new participants,” an analyst at Swissblock wrote on a Telegram broadcast. “The fluidity is stable and there has been no unstable shaking since early 2025.”

“When liquidity gauges are held above 50 lines, short-term price action tends to bring about strength,” said an analyst at SwissBlock. “As network growth is adjusted, key levels are not only being reconsidered, they’re accumulating.”

“It’s a kind of structural support that supports sustainable gatherings,” they concluded.