Since its launch in April, Bitcoin (BTC) has experienced an unusual increase in convictions from both short-term and long-term holders.

Short-term holders who hold Bitcoin under 155 days are usually more responsive to price movements, often buying during euphoria and selling during recessions, according to GlassNode.

However, it appears that recent short-term holders are now value-driven buyers, despite being around 25% below their all-time high.

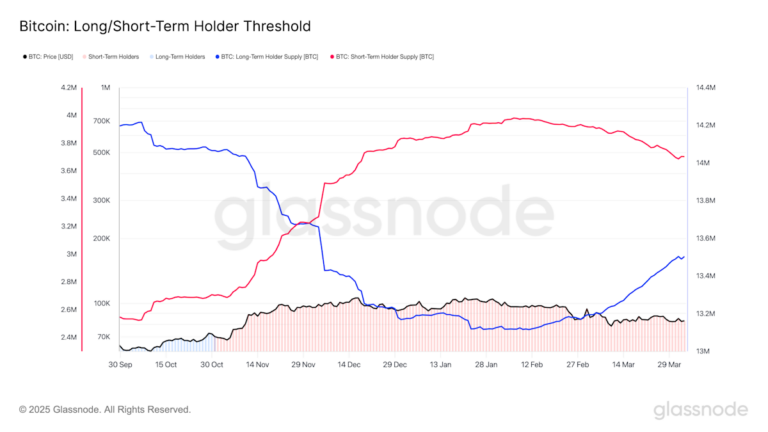

Since its launch in April, the group has increased by around 15,000 BTC, and now holds a total of 3.7 million BTC. That said, since February, they have distributed around 280,000 BTC. This was a combination of profits from the November and December rally, following President Donald Trump’s election victory. This adds to Bitcoin’s panic sales during its January record 30% drawdown.

Long-term holders, who have held for at least 155 days, have increased Coinstash by 400,000 BTC since February, and acquired small quantities this month, exceeding 13.5 million overall tally. This suggests a growing conviction among long-term holders, even amid the recent price stagnation.

Bitcoin has remained relatively flat since its launch in April, but the Nasdaq has fallen 3.5% over the same time frame, with futures showing an additional 3% decline.