(Bloomberg) – Cryptocurrency slipped as fears of selling US stocks robbed President Donald Trump’s recent efforts and fears of his buttressing efforts to the industry.

Most of them read from Bloomberg

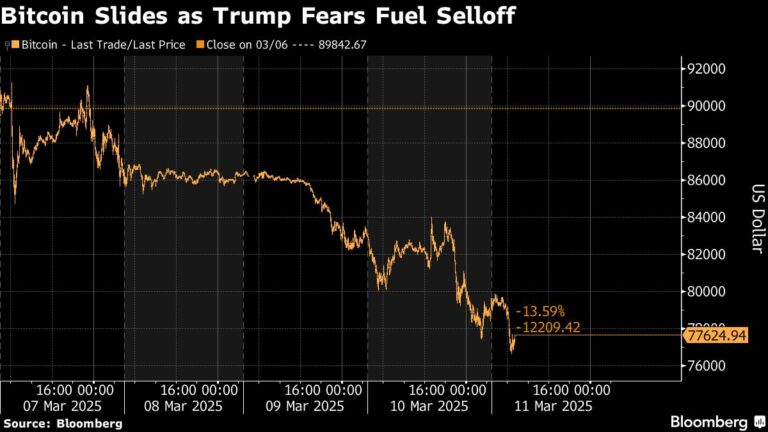

Bitcoin fell more than 3% on Tuesday morning in Asia, with the second-place token ether down from 6% to $1,756, according to data compiled by Bloomberg. Both tokens later blocked their losses.

The initial decline came after the sale of US stocks acquired by Technology Stock. The Tech Heavy Nasdaq 100 index plummeted 3.8% on its worst day since October 2022. Wall Street is volatile after Trump warned that he might feel “small obstruction” that stems from the trade war with Canada, Mexico and China. Strategists and economists across the street have increased the likelihood of a US recession.

“With the industry has a strategic Bitcoin Reserve executive order, Crypto has one less positive catalyst to raise prices and is merciless with the macro-risk appeal.”

Trump ordered the creation of another stockpile of US Bitcoin Reserve and other tokens ahead of the well-known crypto summit with Washington industry executives on March 7. The order has allowed the Ministry of Finance and Commerce to develop a “budget neutral strategy” to buy more Bitcoin. This means that the government will not get any additional codes for stockpiling.

“The market appears to be currently responding negatively to the preliminary announcement,” said Hayden Hughes, head of Crypto Investments at Famey Office Evergreen Growth. “But my estimation is, this is really an exaggeration and the market now appears to be very selling,” he added.

Among the biggest losers in the overall market selling on Monday was exchange sales funds that sought to provide juice up returns for digital assets or crypto-related themes. The two ETFs used to make bets leveraged to Strategy, a Bitcoin Holding Company previously known as MicroStrategy, fell by more than 30% that day.

Bitcoin was trading in Singapore for $79,300 as of 10:52am on Tuesday. According to Hughes, the largest digital assets are expected to find $73,000 and $70,000 in support. “There’s going to be a strong shopping there,” he said.