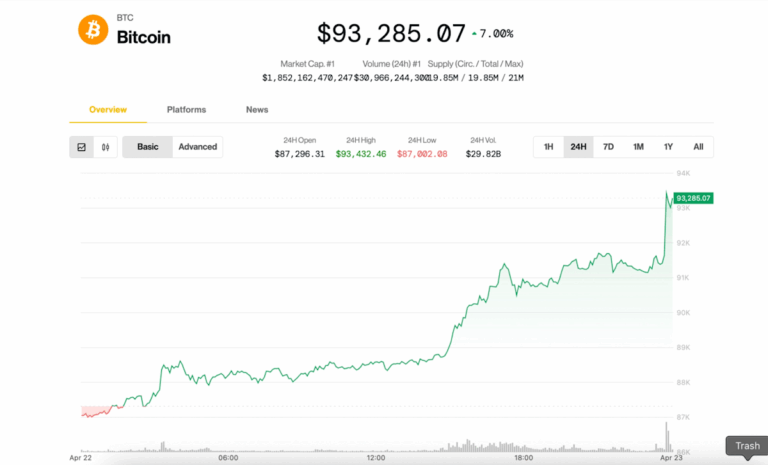

Bitcoin (BTC) surged over $93,000 on Tuesday afternoon, rising nearly 7% amid new investor optimism and a new hope of thawing US-China trade tensions, but analytics company Cryptuant flows back even further upside down through Cauted.

The market was supported by morning remarks from US Treasury Secretary Scott Bescent. Bessent said de-escalation would come in “the very near future,” and that it marks the current conditions as a “trade embargo.” However, he warned that a more comprehensive deal between the two countries could take years.

President Trump then spoke with White House reporters late in the afternoon, saying that US tariffs on China would “essentially” fall from the current 145% level, easing concerns about a spiral trade war.

He also added that he has no intention of firing Federal Reserve Chairman Jerome Powell after pressure to lower interest rates based on recent pressure on the head of the US Central Bank.

The biggest encryption by market capitalization is shy at $93,400, following Trump’s comments, at its strongest price since early March. Altcoins chased BTC, with Ethereum’s Ether (ETH) gaining 8% above $1,700 in the last 24 hours, and Dogecoin (Doge) and SUI’s Native Token (SUI) earning 8.6% and 11.7%, respectively. The Crypto Benchmark Coindesk 20 Index rose 5.2% in a significant market.

Stock was collected from yesterday’s decline, with the S&P 500 and the high-tech NASDAQ finishing the session with 2.5% and 2.7%, respectively. Meanwhile, Gold has rebounded sharply from a record price of $3,500 during the day, falling 1%.

“When capital is turned into safe haven and inflation hedge assets, BTC and gold have proven to be key beneficiaries of Exodus from USD risk,” an analyst at hedge fund QCP Capital said in a telegram broadcast.

They highlight the influx of revitalization to find rebates of US registered BTC ETFs and so-called Coinbase price premiums, suggesting demand from American institutional investors. BTC ETF booked more than $381 million net inflows on Monday, according to data from Farside Investors.

But not all signs refer to a sustained breakout.

Despite the price hike, on-chain data points to under-surface vulnerabilities, crypto-legged analysts said in a report Tuesday.

Clear demand for Bitcoin has dropped by 146,000 BTC over the past 30 days. This is an improvement due to the sharp decline in March, but it is still negative. Cryptoquant’s demand momentum metric, tracking new investors’ interests, has degraded to even weaker levels since October 2024, the report says.