Crypto Insurance Market is in its early stages and, according to a GlobalData research, it is difficult to find a cover. With cryptocurrencies becoming increasingly popular, there are significant growth opportunities for insurance companies, but more providers will emerge in this sector.

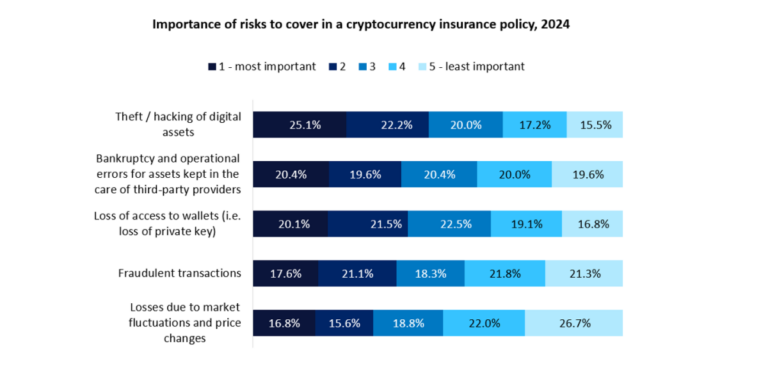

According to GlobalData’s 2024 Emerging Trends Insurance Consumer Survey, only 10.8% of cryptocurrency holders worldwide have insurance on digital assets. However, 41.9% of non-politicians will buy the policy if it is offered, but an additional 26.2% can. This indicates a strong demand for products that protect such digital assets from financial losses. Further findings from the survey show that digital asset theft or hacking is considered the most important risk covered by crypto insurance, with one-quarter (25.1%) of consumers making this the most important policy feature It has been revealed that they are ranked. Insurers should prioritize developing policies that cover the features that customers most desirable.

Historically, insurers have been hesitant to provide cryptocurrency coverage due to skepticism. They are non-traditional non-physical assets and lack historical data for underwriting. Cryptocurrencies are also rarely regulated and are extremely unstable. As a result, insurance companies continue to view Crypto Insurance as a very dangerous product.

As a result, the number of insurers offering cryptocurrency insurance remains limited, but this figure is gradually increasing. In a recent move, the US-based group of blockchain deposit insurance consultants has launched a new international organization, Blockchain Deposit Insurance Corporation (BDIC), to provide cryptocurrency. Bermuda-based BDIC offers digital wallet coverage for some cryptocurrencies, including Bitcoin, Ethereum and Solana. BDIC reportedly plans to seek the status of Lloyd’s cover holder. This allows you to take on the risks of complex cryptocurrency.

As cryptocurrencies become more and more common, so does insurance demand, and more providers will emerge. To seize opportunities, the insurance industry must address unique risks associated with cryptocurrency through innovative solutions that mitigate and protect these new risks from losses. Policyholders feel at ease knowing that they will receive financial security in the event of an unexpected incident, such as loss of private key, hacking accounts, or trading errors.

“As digital assets become increasingly popular, the strong appetite of cryptocurrency” was originally created and published by Life Insurance International, a brand owned by GlobalData.

The story continues