Figment, a leading player in blockchain staking services, is actively seeking to buy businesses in the fuss of crypto industry integration caused by new optimism about US regulations clarity.

The Toronto-based company targets $100 million to $200 million acquisitions and has a strong regional presence within the blockchain ecosystem, such as COSMOS and Solana. He said the company has already put out term sheets for several transactions, the report added.

Figment helps institutions to earn yields through staking. This helps to ensure a blockchain network and validate the transactions the network supports. The company currently manages around $15 billion in betting assets and employs around 150 people, Gabel said.

The gusts of the Crypto deal, including the $1.5 billion purchase of Kraken’s Ninjatrader and the $1.25 billion acquisition of Ripple’s Hidden Road, come when the Trump administration brings a more crypto-friendly regulatory environment. In that environment, the US Securities and Exchange Commission filed lawsuits against various crypto companies.

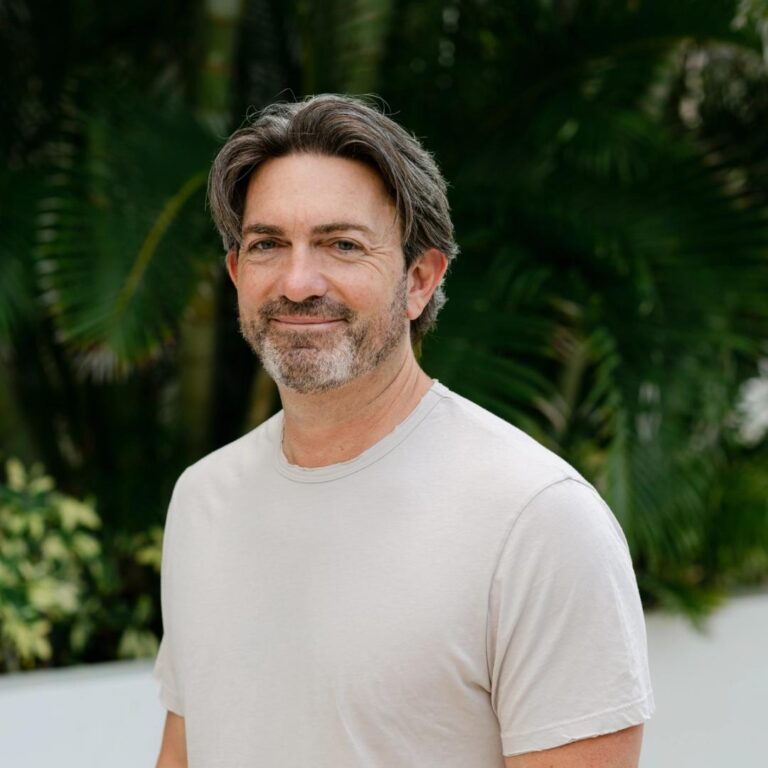

Despite the acquisition strategy, Figment does not seek additional funds and excludes the sale. Gabel, who co-founded the company and launched three previous startups, said he is committed to building the figment over the long term. “I would rather go to Zero,” he said.

The company has raised $165 million so far, according to data from Thetie. That latest Series C funding round was led by Thoma Bravo and saw participation from giants such as Morgan Stanley, Starkwave and Franklin Templeton India.

Read more: Kraken joins US Crypto Futures Market by Buying Ninjatrader for $1.5 billion