(Bloomberg) -Bitcoin has extended the biggest jump in more than a week after the latest monetary policy meeting in the Federal Reserve and Chairman Jerome Powell, who temporarily touched the cryptographic regulation.

Most read from Bloomberg

The largest digital assets increased 1.3 % as of Thursday at 8:30 am, about $ 105,134, which increased by 3.5 % yesterday. I also pressed small tokens such as ETHER and Solana.

On Wednesday, the Fed officials have paused monetary easing, Powell is a customary briefing, and the central bank needs to increase the progress of inflation before considering further reductions in interest rates.

In response to questions regarding risks from digital assets, banks stated that “it is possible to provide full service to encrypted customers as much as possible, as much as possible, as much as possible.” Was added “very very”. Constructive. “

Comments were stably measured, but the investor’s expectations for friendly digital asset regulations under President Donald Trump, who have strictly accepting the cipher sector, are gaining in the background of investors’ expectations.

“Mature” rally

“The US trader has responded to the comments of the cipher from Powell, and the bitcoin has been pushed up high,” said Ig Australia PTY Market Analyst Tony Sycamore. “From a wider and technical point of view, it indicates that the bitcoin rally is mature.”

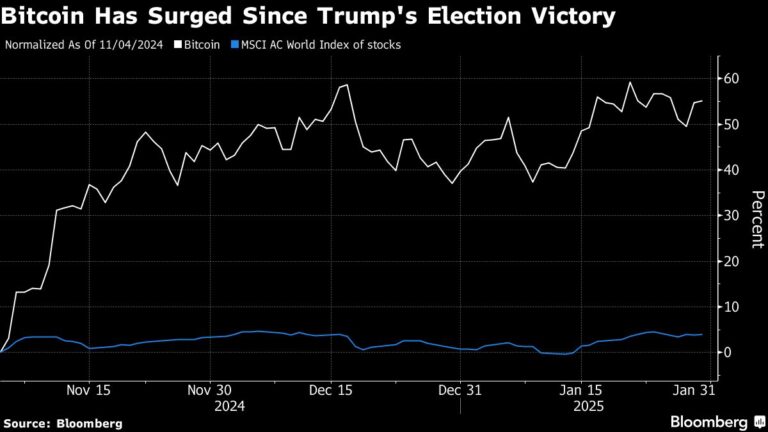

Bitcoin recorded $ 109,241 prior to Trump’s inauguration ceremony on January 20, but returned. Token has increased by more than 50 % since winning the election in early November, and some people ask if the rally is a breathtaking.

Others argue that expanding the relationship with encryption will make more profits. The latest development includes the movement of CME Group Inc. to develop futures products in the Robinhood Markets Inc. app, which contains Bitcoin and Ether.

In addition, investment companies are struggling with the Securities and Exchange Commission with proposals to launch more encrypted sales funds. Natandeen, a Bloomberg Intelligence Senior Analyst Analyst, wrote in a memo, “SEC’s boundary of unique submitted documents, including Memecoin ETFs.”

Bitcoin’s movements have recently been correlated with US technology share. As a result, the investor may have benefited from the increase in Nasdaq 100 Equity futures on Thursday.

The story will continue