If the economy appears to be increasingly off course, it may be that even worse, it may not have come yet.

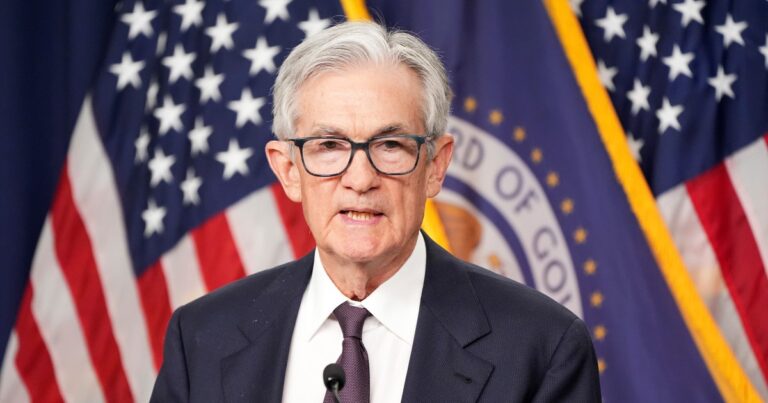

The Federal Reserve is set to not change interest rates as it continues to assess the economic impact of President Donald Trump’s tariffs, particularly the threat of rising prices.

But amid continuing signs that the job market is slowing, new challenges are facing central banks.

One of the most alarming signals of that slowdown is seen in the continued unemployed claims, or in the measure of unemployment insurance claims by people who have been in employment for weeks. Last week, that number reached just 2 million, a mere 2 million since November 2021.

The numbers are still low by historical standards, but this trend is unmistakable. At the same time, employment rates remain unprecedented for over a decade.

“The labor market looks good on the surface, but the trajectory is concerning,” Preston Mui, a senior economist at Employ America, a research group that advocates full employment, wrote in a memo released Monday.

Mui noted that labor participation and overall employment is declining. “There are many stories about why the labor market is cracking,” he said.

The Federal Reserve is entrusted by Congress to keep both unemployment and inflation low. It helps you do that by controlling the cost of borrowing money. By making it more expensive for businesses and consumers to take away loans, the Fed is trying to control how quickly the economy expands. Higher interest rates are designed to control inflation, while lower interest rates drive business expansion and employment growth.

Even with a worsening employment picture, analysts say the Fed is focusing on closing inflation. Wall Street traders essentially put the odds on interest rate cuts in June to zero, with an approximately 80% chance that prices will remain unchanged until July.

It continues to appeal for lower interest rates and is not working well with Trump, who claims there is no inflation. It is true that some of the recent inflation reports have been milder than expected. Meanwhile, the decline in retail spending last month was worse than expected, suggesting that the economy continues to slow down, suggesting that borrowing rates could lead to unnecessary slower consumption.

Still, other studies have shown an increase in prices paid by businesses, possibly in response to customs duties. Other analysts say price growth is too early given the fact that repeated tariffs have been rolled out and many businesses and consumers have increased their purchases ahead of import duties.

“We hope to see an unusually significant rise in product prices by the second half of the summer,” City Analyst said in a memo this week. “You can see signs of tariff impact immediately in June with components like AUTOS.”

However, Citi analysts also warned that there is another possibility. The demand is that businesses are too weak to pass on higher tariff costs significantly. They have noted that over the past few months, the prices of services such as airfares, hotels and recreation have been very weak.

“Soft demand suggests that rising prices from tariffs is unlikely to lead to sustained inflationary pressures spreading across services and products that have affected non-tariffs,” they write.

In general, the nature of consumer price data makes it difficult to know how well prices from customs duties go, and how high prices are earned, they write. That would have made the chance that Trump would prove right and the Fed should have lowered the rates sooner.

Either way, the economic background is a concern, said Mark Zandy, chief economist at Moody’s analysis.

“The economy will be uncomfortable for the rest of the year,” he said, saying that while it remains vulnerable to external shocks like the Middle East conflict, there is a high possibility that inflation will increase.

“We haven’t seen the economy kick up for a long time,” Zandi added.