Cardano’s ADA and XRP led losses between majors on Tuesday. Traders are awaiting the outcome of the upcoming Federal Reserve (FOMC) conference.

Bitcoin (BTC) prices remained above $94,000 after temporarily falling below that level on Sunday, continuing to operate tied to recent ranges.

ADA prices fell almost 4%, but XRP slides as well. Ether (ETH) has dropped by almost 1%, BNB in the BNB chain has risen by 1.3%, and MemeCoin Dogecoin (DOGE) has dropped by 2% over the past 24 hours.

The Broad-based Coindesk 20 (CD20), a liquid index that tracks the largest token by market capitalization, has just over 1.8%.

Elsewhere, some Defi Tokens, such as Aave, Curve’s CRV and Hyperliquid hype, have been seen in demand over the past week with signs of trader interest in projects with utility and yield mechanisms.

“When Memocoin is no longer preferred, traders are turning to stronger fundamentals and token economics projects,” said Kay Lou, CEO of Hashkeye Collab.

“Defi Ecosystems benefits from this pivot, especially as Bitcoin shows that there is still a decline in volatility and macro uncertainty. We hope that Bitcoin will maintain a decline in volatility and that crypto will serve as a hedge of economic uncertainty,” Lu added.

The hype came out among the top 100 tokens with a 72% surge last week, with Aave and CRV rising by up to 40%.

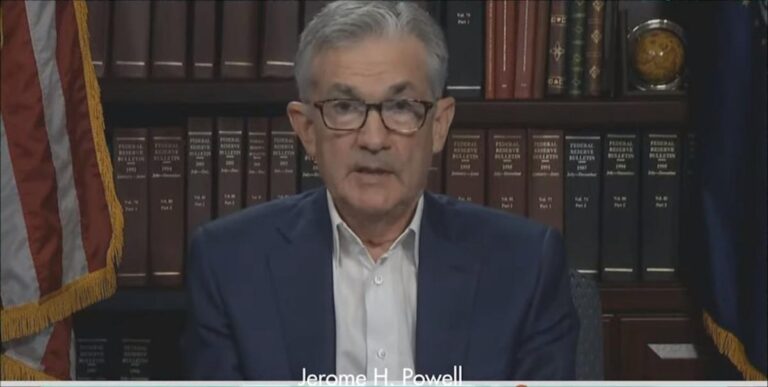

Traders in both crypto and traditional financial markets are keeping an eye on this week’s FOMC rate decision, with consensus expectations pointing to a pause in rate hikes.

However, uncertainty about inflation, tariffs and wider US-China trade tensions has led to many participants being cautious.

“We don’t think FOMC will trigger a major market move,” Augustine Fan, Head of Insights at Signalplus, said in a telegram message. “It’s a coin flip of direction. The code will give you clues from wider revenue growth and how the economy will digest the impact of recent trade policies.”

The recent strength of the stock market suggests that investors price around 8% for only mild recession risk, according to historic drawdown models. This contrasts with more bearish signals from bond markets and macroeconomic forecasts, fans added.

Last week, President Trump confirmed that there is no immediate plan for talks with China, attenuating hopes for a breakthrough in US-China trade negotiations. Still, the possibility of separate trade agreements helped keep risk sentiment intact, as reported Monday.