(Bloomberg) – Cryptocurrency investors returned to the market last week, riding on the surge in Bitcoin.

Most of them read from Bloomberg

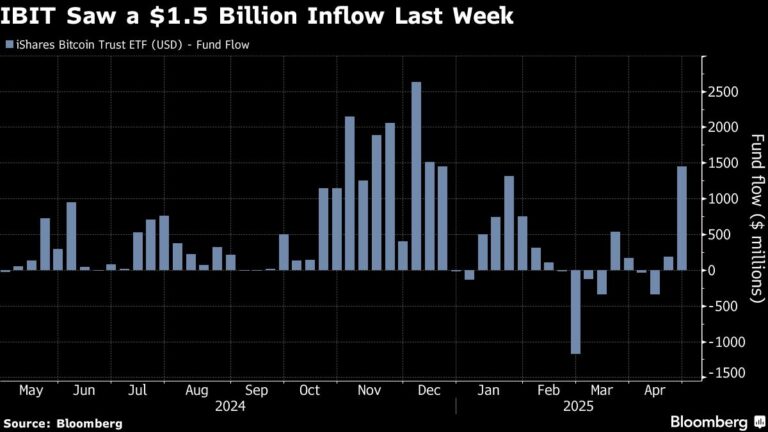

Exchange sales funds tracking Bitcoin and ether attracted more than $3.2 billion last week. The ISHARESBITCOINTRUST ETF (Ticker IBIT) alone has seen nearly $1.5 billion inflows. Other Bitcoin-focused funds also saw meaningful injections. Investors added over $620 million to the ARK 21 share Bitcoin ETF (ARKB) and about $574 million to the loyal, sensible Origin Bitcoin Fund (FBTC).

Meanwhile, Ether products posted its first weekly online influx since February, according to WinterMute data.

The rally unfolded with a significant rise in overall risk assets, including the S&P 500. Bitcoin itself surged 10% to around $94,000, the best week since the days after the US presidential election.

Crypto lovers also point to Bitcoin’s resilience and stocks during the upheavals of President Donald Trump’s trade war and subsequent financial markets. This year the tokens are flat. It’s a pattern that rekindled calls for cryptocurrencies to serve as a new type of safe haven similar to gold, compared to the nearly 6% drop in the S&P 500.

“The influx of netspot ETFs has increased, although it is a barometer of institutional interest in Bitcoin,” wrote Etro’s Simon Peters. “With gold at record highs, can investors see Bitcoin called “digital gold” because of its similar rarity, as a potential safe haven or alternative asset to invest in if economic uncertainty continues? ”

IBIT, the largest Bitcoin ETF with $56 billion assets, has consistent flow this year despite the market shaking violently like Trump shaking amid a variety of tariff policies. In the background, the president made the move to more forcibly accept the crypto space. He had dinner with Trump’s top 220 memocoin holders, the issuer of cryptocurrency announced last week, and spiked prices.

Meanwhile, the election resulted in Bitcoin spikes above $100,000 at one point, resulting in several analysts raising long-term price forecasts for the coin.

The story continues