The Swiss National Bank has refused to hold Bitcoin reserves, citing concerns over liquidity and volatility in the cryptocurrency market.

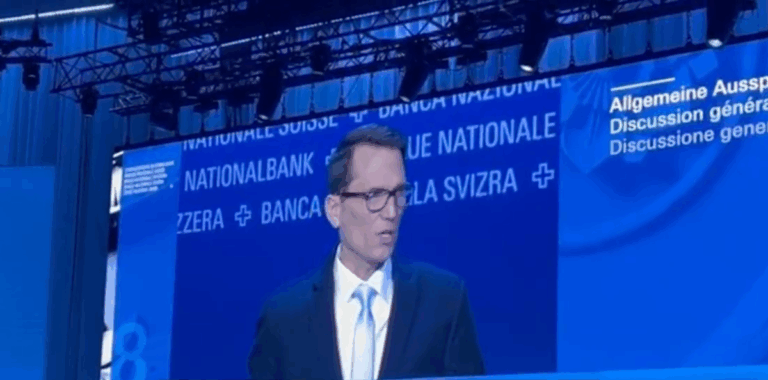

“In the case of cryptocurrencies, market liquidity may sometimes seem ok, especially during a crisis that is naturally questioned.”

“Cryptocurrencies are also known for their high volatility, a risk of long-term value retention. In short, cryptocurrencies do not meet the high requirements for currency reserves at this time.”

Unknown block type “jwpvideo”, specify that component with the `components.types` option

Schlegel’s comments were prompted by the Bitcoin Initiative, a Bitcoin advocacy group. The study adds Bitcoin to the Swiss Treasury, which complements the overall portfolio, minimizing volatility and brings substantial returns.

Without Bitcoin, investments at the Swiss National Bank have increased by around 10% since 2015. According to the Bitcoin Initiative Portfolio Simulation, the 1% Bitcoin allocation to central bank portfolios has almost doubled over the same period. The annual volatility would have increased slightly.

The Bitcoin Initiative emphasized that Bitcoin volatility should not be evaluated on its own, but should be evaluated in terms of the overall dynamics and impact on performance of the investment portfolio.

“(Bitcoin) prices have reached new highs, showing resilience under market stress, and even on bank holidays, double-digit trading volumes remain extremely liquid every day and evening.”

“The Bitcoin Network continues to be one of the most reliable and secure IT systems ever created. Most surprising is that the US has launched a strategic Bitcoin stockpile.”

In an email statement to Coindesk, Bitcoin initiative suggested that the Swiss National Bank’s dislike for Bitcoin could be political. This is because it can harm “an expression of distrust over other currencies” and sensitive relations between Switzerland and the European Union.

The president of European Central Bank Christine Lagarde has consistently criticised Bitcoin, calling it “no value” and a “highly speculative asset” associated with money laundering. In January, Lagarde said “Bitcoin will not be in the central bank reserves of the ECB’s General Council.”

It responded to comments made by Czech National Bank Governor Yale Mickle, who appreciated his agency’s assessment of the addition of Bitcoin in its preparation. Lagarde argued that Bitcoin did not meet the ECB’s standards for liquidity, security and safety from the Criminal Association.

The story continues