Bitcoin is a top asset in the crypto sector, universally defined as a commodity by US regulators and courts, and is placed under the jurisdiction of the Commodity Futures Trade Commission. The agency is currently seeking public comment on whether it should open up a wider world of derivatives in 24-hour trading, as already implemented on Bitcoin and other digital assets.

The CFTC is expected to be established as a crypto market regulator in Congress’s ongoing efforts to establish industrial rules, but the agency’s invitation to comments issued Monday does not explicitly discuss monitoring of digital assets. This demand points to the fact that “technological advancements and market demand” allows CFTC-regulated companies to handle transactions at all times.

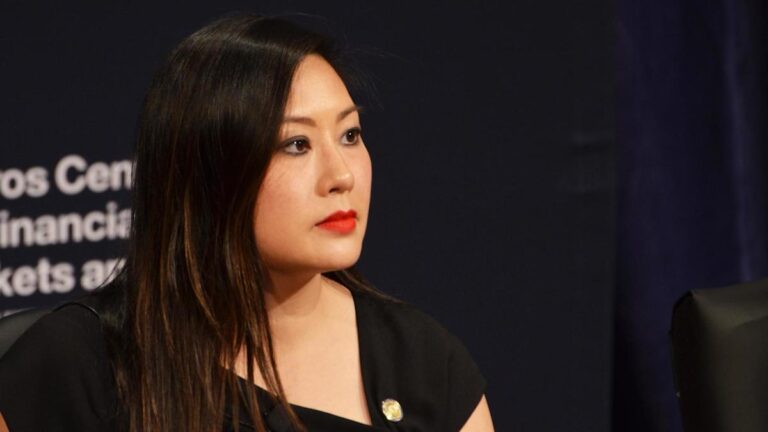

“As I have said for a long time, the CFTC must take a forward-looking approach to shifting market structures and ensure that the market remains vibrant and resilient while protecting all participants,” she was tapped to run the agency while President Donald Trump awaiting confirmation of the Senate of Chairman’s candidate Brian Quintz.

Trading without downtime presents many challenges to the US market as per requests, such as “governance frameworks, exchange models, and technologies are necessary to ensure market integrity and operational resilience, and to ensure compliance with all core principles under the ongoing trading model.” Such an expansion requires companies to handle the long-term system and market live maintenance and technology patches and human surveillance, which are issues that have already been long struggled with digital asset management.

CFTCs will need to change the law before they have direct authority over actual spot market transactions for Bitcoin and other tokens that are not ultimately classified as securities. If the agent is ultimately the main regulator of the transaction, and the platform and company regulator that handles customer transactions, it is a space where 24-hour, seven-day activity is already a model.