Bitcoin (Cryptography: BTC) Sometimes called “digital gold,” it is a safe shelter type investment that suggests it can be useful in hedging stock market volatility. But is that really true? How it took place this year, and during the last massive market crash, it appears to be the complete opposite.

Gold is supposed to provide investors with some stability during difficult times. It is generally considered a good way to store value, and investors usually flock to it when they are worried about the economy and the market in general. Crypto Investors considers Bitcoin to potentially fulfill the same role, but it thinks it in a digital way.

Where would you invest $1,000 now? Our team of analysts has revealed what we believe is the 10 best stocks to buy now. Continues “

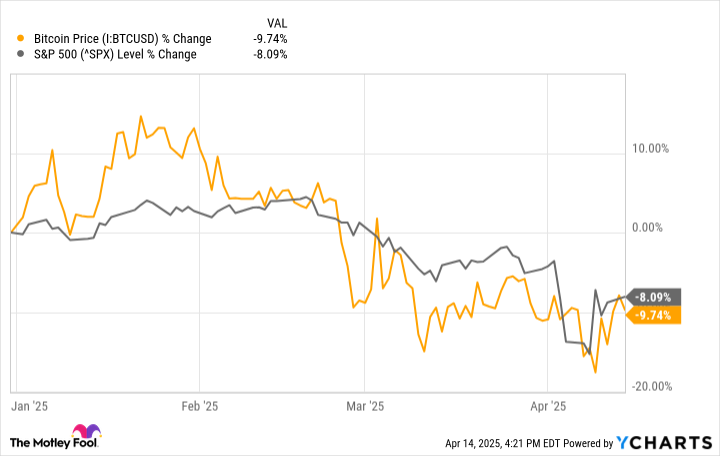

However, due to the recent release of growing concerns about global tariffs and potential recession, Bitcoin has been anything but a safe haven investment, as the S&P 500 index of free falls in recent weeks is on the horizon.

Not only has it been unable to provide investors with some kind of safety, it is worse than the market. The chart above is similar to the opposite of hedge, and may instead suggest that Bitcoin is highly correlated with the S&P 500.

Bitcoin and the S&P 500 are crashing, but the actual physical value of gold is increasing. As investors had expected, it served as a safe hedge against the market. Recently, Gold reached a new all-time high of $3,245 as concerns about a slowdown remained high. For now, physical assets have proven to be a much more stable option for investors looking to minimize risk. Bitcoin investors may think cryptocurrencies are just as good, but they have not proven to be the case this year or 2022.

Holds a share position in SPDR Gold (nysemkt:gld) The Exchange-Traded Fund, backed by physical gold, has proven to be a better way to offset risk in the market this year. It has increased by more than 22% since January.

Bitcoin is a speculative investment, and that won’t change anytime soon. Often due to wild movements, you won’t be appealing to risk-averse investors.

I consider it a way to measure the overall risk appetite of the market. If there is high enthusiasm and investors appear to be indifferent towards valuations, Bitcoin is rising sharply, and so is the market. The S&P 500 has performed quite a bit earlier this year as investors didn’t think about the empty value of many popular stocks, but as that changed, the index struggled as well as the Bitcoin price.

The story continues