A series of fresh trade warnings loaded Wall Street with barrel versions on Wednesday, pushing down three major US stock indices in the latest indications of turbulence from White House policies.

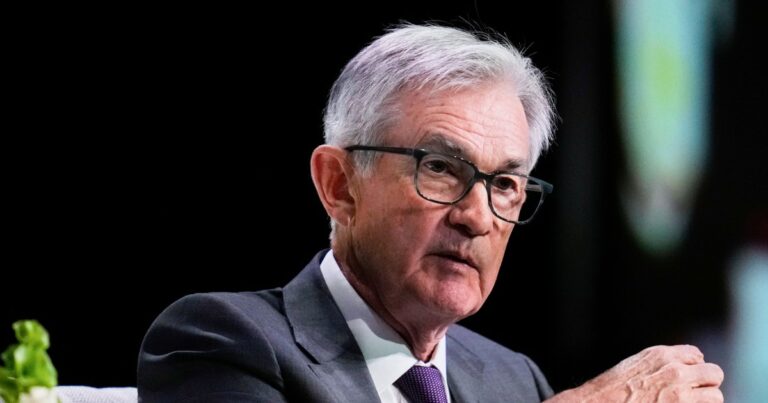

Trading days began with sell-offs as two AI chip makers individually warned that US export controls would increase costs. Later that day, Federal Reserve Chairman Jerome Powell said tariffs threatened fuel inflation, which added to the market slump.

Nvidia said late Tuesday it is expected to record a $5.5 billion claim to comply with new Trump administration rules dealing with “the risk of using or repurposing (chips) on Chinese supercomputers.” Nvidia said Trump officials have shown that curbs will be essentially “for an indefinite future.”

Nvidia’s shares fell 7% on Wednesday as investors dumped the company’s stock and dumped shares in fellow chipmakers and many other high-tech companies. AMD, one of Nvidia’s top competitors, also dropped more than 7% after warning of a $800 million claim related to the Mi308 GPU chip and revealed it would be a hit from updated export controls. Shares in other chipmakers also slipped, with ASML shutting down 7%, while Micron, Broadcom and Marvell each fell by more than 2%.

The high-tech Nasdaq fell 3% on Wednesday, while the S&P 500 fell 2.2%. The Dow Jones industrial average fell 1.7%, or 700 points.

Investors were still digesting the chip industry warnings when Federal Reserve Chairman Jerome Powell said on Wednesday afternoon that the White House tariff policy could “produce at least a temporary increase in inflation.”

“The inflation effect could also be more sustainable,” Powell said, “so far it suggests that growth has slowed in the first quarter of last year.” He added, “For the time being, we are well positioned to wait for more clarity before considering adjusting our policy stance.”

His comments sent the stock index to a fresh low as investors stably bet on the Fed’s interest rates. JPMorgan economists have repeatedly predicted that the central bank will not lower prices again until September.

Large companies typically record fees for one-off expenses or expected revenue reductions. Nvidia said in its latest warning that export curbs will affect H20 processors. This is a type of AI chip specially designed to comply with Biden-era regulations for selling high-tech products to China. CNBC reported that the H20 line generated an estimated $12 billion to $15 billion in revenue in 2024.

Chipmaker’s stock dive comes two days after Nvidia announced plans to manufacture part of its AI chip for the first time in the US. The company said Monday it is developing facilities in Arizona and Texas, in news that the White House has been hailed as “Trump Effect Action.”

Nvidia is now worth nearly $3 trillion, pioneering the wider market, thanks to the wider adoption of chips by companies racing to enhance the capabilities of artificial intelligence.

Chip Giant stocks have plummeted about 23% so far this year as President Donald Trump’s trade war is expanding. The president is escalating tensions with China, and is currently facing 145% tariffs, indicating that new import taxes on foreign semiconductors will soon arrive over the weekend.

The stock decline on Wednesday was wiped out nearly $300 billion from Nvidia’s market value, with the stock performing worst on the Nasdaq 100 and S&P 500 index.

Wall Street has endured weeks since Trump announced on April 2 that he would clean up new tariffs.

The S&P 500 has still fallen by about 8% since its rollout. The Nasdaq has dropped by almost 9%, while the Dow remains at about 6.5% lower.