(Bloomberg) – The new cryptocurrency is intended to occupy the ultimate frontier of investor safety.

Most of them read from Bloomberg

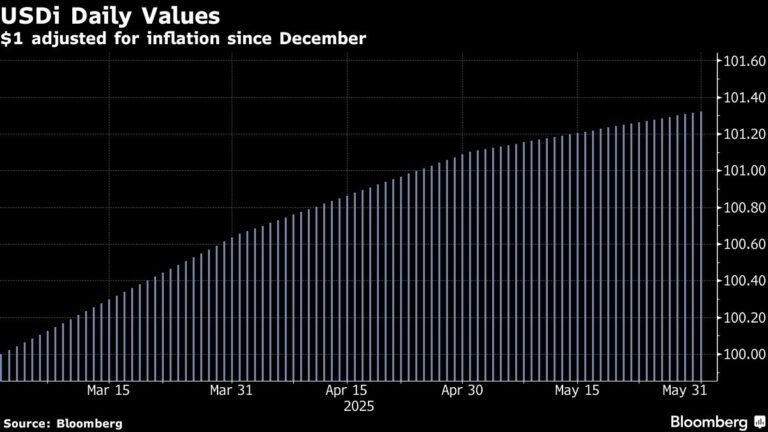

USDI is a stable dollar tracking formula launched by two veterans of US inflation-protected foreign exchange derivatives and is valued by an increase in the US consumer price index since December 2024. On April 15th, it was $1.00863.

Inflation protection in the US market has been available to investors since 1997 through the Treasury Department’s inflation protection securities, or tips. However, as bonds, when interest rates rise, they are subject to losses. This is the result of surprising some investors who built up their hint ETFs as inflation accelerated in 2021.

According to Michael Ashton, who began his career in inflation-protected investments at Barclays PLC in the early 2000s, USDI is comparable to a principal or, in theory, an inflation-protected savings account.

“There’s no real risk-free assets. It’s cash related to inflation,” Ashton said. “Keeping cash is an option for future opportunities, and the cost of that option is inflation. If you are creating cash related to inflation, that is the end of the risk line.”

As USDI Partners LLC explained in a statement, tokens will have as much purchasing power as dollars in December 2024. USDI, like the principal of the day, creates and burns coins with values stated to be a function of the CPI of the day.

The government publishes CPIs only once a month, but interpolates daily value that compensates for the hints investors use to calculate the profits they have acquired. The CPI value determines the hint and USDI index value with a delay of 2 months. In other words, the December CPI map is open until March 1st, and the values are open until May 31st. The April 15th value of USDI is calculated by splitting the CPI for that day.

In that sense, it is different from stubcoins whose value is fixed in dollars. There are dozens of them, with a total market value of over $200 billion. Initially, they were mainly used as conduits for trading other cryptocurrencies. A new token has been created to be used as collateral.

“It’s a stable coin in real space,” Ashton says. It means it will be adjusted to inflation, like the actual GDP figures that measure the real US economic growth.

The inspiration for this product comes from Unidade de Foments in Chile, an accounting unit indexed to national price levels since 1967. The UF used in contracts to isolate amounts from inflation is an acyclical currency.

In contrast, USDI will be supported by a reserve fund that since October 2021, administered in parallel with the permanent US Inflation Tracking Fund that Ashton has operated for accredited investors. The fund holds tips, regular US Treasury obligations, foreign exchange and commodity futures and options. Leverage is not used.

According to Ashton, the fund managed by Trident Fund Management returned 4.48% per year over the three years ended March, with a median monthly return of more than 15 basis points.

In contrast to algorithmic tokens, their value depends on the assets that support them, so USDI’s reserve funds are not stained with blockchain, and the value of the coin is unrelated to the performance of the asset. Rather, he said the coin is a primary duty of the USDI partners, with everyone being cashed out and other assets being available if the assets in the reserve fund are exhausted.

“The value here is derived not from the blockchain itself, but from real-world assets that earn real-world returns,” he said. Furthermore, the value of a coin is not linked to the value of an asset. Rather, it “relies on the exogenous march of the CPI.”

As a practical matter, it means that the backer will cast or burn USDI at daily value. This reduces trading fees between zero and one basis point depending on the size. That applies regardless of the market capitalization of the coin. This does not have an initial minimum.

USDI partners create and burn the institution coins in exchange for dollars. The token will be available to accredited investors from approved market production companies that have not yet been named. On these platforms, USDI can be exchanged for USDC, a dollar stablecoin managed by the Circle Internet Financial Group. Trades on the Ethereum blockchain.

Ashton’s partner in ventures is Andrew Ferry, who began his four-year career in forex options in the early 1980s. This included a lengthy stint at Lehman Brothers and Barclays, which advised corporate clients on the use of options to hedge cash flows.

USDI is an equivalent project in the sense that it is “like an exchange rate.” “The exchange rate in your life is based on time. At any point, we estimate that your personal exchange rate is decreasing as prices rise.”

Ashton says USDI could solve the problem he is obsessed with, at least in 2004, as head of Barclays’ inflation derivatives, when it announced how it could break down tips so investors could buy inflation protection against the subset of CPIs that were most exposed, as if they were against the index.

For example, in theory, you could purchase inflation protections in healthcare and university tuition fees. It never happened because there was not enough demand for the rest of the CPI basket.

In traditional finance, Ashton said “every piece of work must be able to be sold.” In the crypto, if USDI is split into all components of the CPI and their total price is less than the value of the coin, “We take them and return the USDI. The joint arbitration limits how ridiculous the price is.

Most of them read from Bloomberg BusinessWeek

©2025 Bloomberg LP