It was more than 40 years ago that the US Federal Trade Commission (FTC) was able to dissolve major companies, with the AT&T split.

The blockbuster antitrust incident against Facebook, Instagram and WhatsApp’s parent company Meta began in the US in Washington, DC.

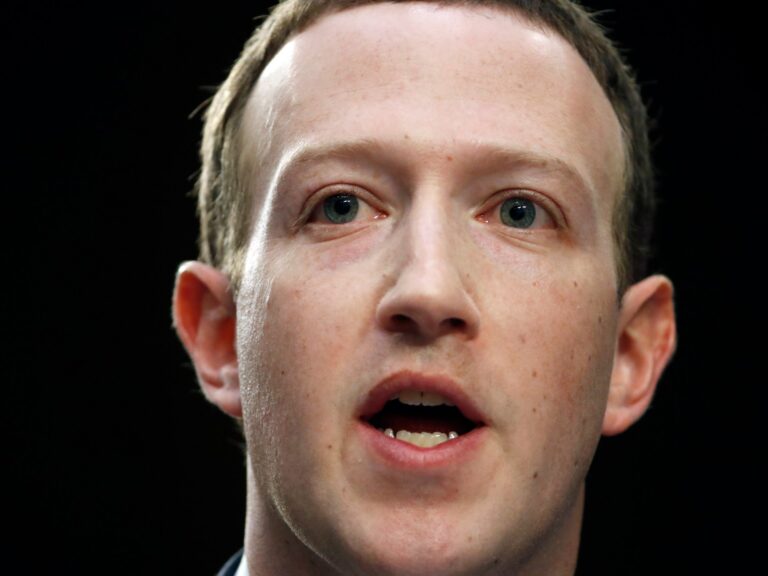

Founder and CEO Mark Zuckerberg is on his feet for the second day in a row today. The groundbreaking case accuses Meta of taking over Instagram and WhatsApp before becoming a competitor.

The lawsuit is the culmination of nearly six years of research into whether the social media giant violated US competition laws when buying Instagram and WhatsApp. At risk is the future of Meta’s $1.4 trillion advertising business, with the prospect of having to spin off its highly popular services into separate companies.

Zuckerberg takes political strategy

The federal court trial in Washington shattered Zuckerberg’s hopes that US President Donald Trump’s return to the White House, causing the government to mess up antitrust enforcement against big technology. Zuckerberg, the world’s third most abundant, repeatedly visited the White House as he tried to convince the president to choose a settlement instead of fighting the trial.

As part of his lobbying efforts, Zuckerberg contributed to Trump’s inauguration fund and overhauled his content moderation policy. He also bought a $23 million mansion in Washington, which was seen as a bid to spend more time approaching the centre of political power.

However, the US Federal Trade Commission (FTC) has not expressed interest in making any pushes against the meta. Trump-appointed FTC chair Andrew Ferguson said in an interview with Fox Business that the agency won’t make a monopoly like Meta again. Ferguson’s push is nowhere near Lina Kahn, former FTC chairman, who was known to be tough on big technology under former US President Joe Biden.

In this case, we see that Facebook owners are forced to sell Instagram and WhatsApp.

The lawsuit was originally filed in December 2020 during the first Trump administration, with all eyes being asked to stand up to the FTC when the Republican president returns to the White House.

Over 10 years of acquisition

The heart of the case is Facebook’s $1 billion Instagram purchase in 2012. It is a small, promising photo sharing app that has since boasted 20 billion active users.

An email from Zuckerberg cited by the FTC described the appearance of Instagram as “really scary,” adding that this is “why I would like to consider paying a lot of money for this.”

On the first day of Monday’s testimony, Zuckerberg downplayed these interactions as early as before Instagram’s plans were put together.

However, the FTC claims that Meta’s $19 billion WhatsApp acquisition in 2014 follows the same pattern, with Zuckerberg fearing that messaging apps will be transformed into social networks or purchased by competitors.

Meta’s defense attorneys counter that substantial investments have transformed these acquisitions into today’s blockbusters.

It also emphasizes that Meta’s apps are free to users and face intense competition.

“They decided that it was too difficult to compete and it would be easier to buy a rival than to compete with them,” FTC lawyer Daniel Matheson said in a statement Monday.

Meta is pushed back

Meta lawyer Mark Hansen retorted in his first salvo that “acquiring to improve and grow the acquired companies” was not illegal in the US, and that’s what Facebook did.

An important part of the court battle is how the FTC defines the market for meta.

The US government claims that Facebook and Instagram are key players in apps that offer a way to connect with family and friends, a category that does not include Tiktok or YouTube.

But Meta disagrees.

“The evidence at the trial shows what every 17-year-old in the world knows. Instagram, Facebook and WhatsApp are competing with China-owned Tiktok, YouTube, X, Imessage and more,” the news agency told Reuters.

If the FTC ultimately succeeds in its efforts to dissolve Meta, it will be the first time in 40 years that an agency has forced a company to dissolve. In the early 1980s, the FTC forced the telecommunications company AT&T to split.