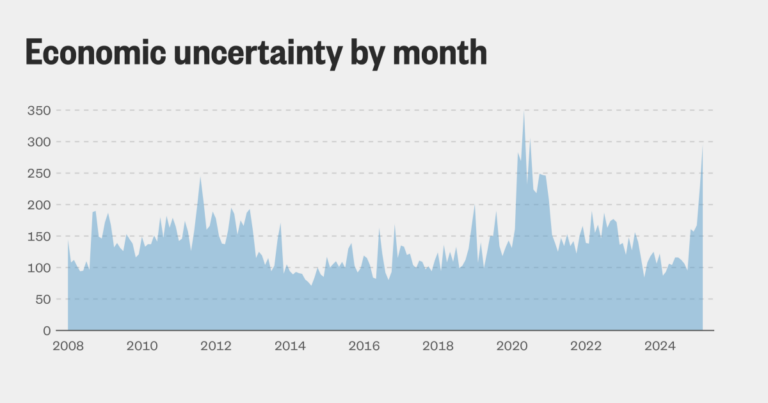

St. Louis Federal Reserve economist Kevin L. Cleesen noted that the change in uncertainty from last spring to this spring was the most sharp increase in almost 40 years.

“It’s an unprecedented increase historically,” Kreesen said.

Instability can make it difficult for businesses and consumers to make decisions and become a scene setter for recession. “Companies will slow down investments in response to increased uncertainty,” Kreesen said. “Consumers facing higher uncertainty about employment outlook may cut their spending.”

“People are in the utmost confusion,” said Menzie Ching, a professor of public relations and economics at the University of Wisconsin.

To demonstrate how uncertainty works, Chin gave examples of potential home buyers. Lowering interest rates may seduce them, but the huge drop in home prices next year, the kind that could arise from the recession, may scare them.

“That’s better news, but it was washed away by this bad uncertainty,” Chin said.

Uncertainty extends to the bond market. Government bonds are sold more than they are purchased.

Bonds that were traditionally considered safe ports tend to be purchased by investors when the market is dominant. That’s not the case today, and the Ministry of Finance’s yield over 4.5% in 10 years.