(Bloomberg) – Bitcoin has recovered from a short-lived sale with signs that cryptocurrencies are weathering market disruptions unlocked by US trade tariffs, which are better than stocks and bonds.

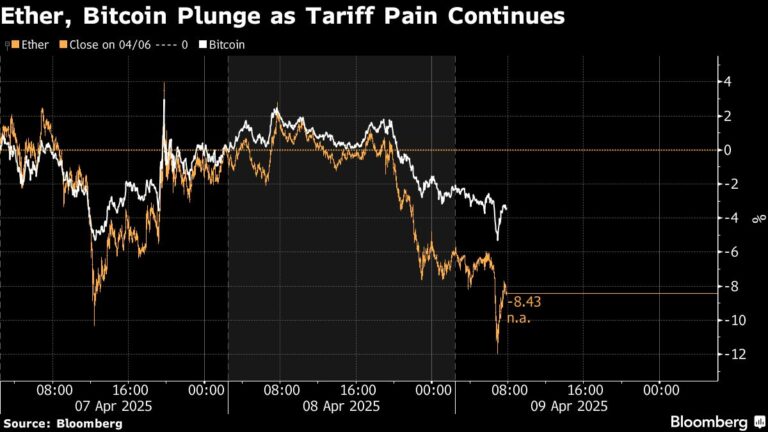

Bitcoin traded about $77,200 in New York at 6:30am after slipping through its previous 3.2%. Ether, the second largest token, also had little change due to the session after reaching its lowest since March 2023. The European stock market fell as President Donald Trump’s tariffs took effect, but sovereign bonds spiked.

Cryptocurrency was one of the stable asset classes on Tuesday as investors dump stocks and bonds and seek shelter. According to Joel Kruger, market strategist at LMAX Group, it reinforces the argument that Bitcoin’s relative outperformance should be included in a portfolio that is against risk.

“Investors are increasingly awakened to Bitcoin’s fundamental value proposition, particularly its appeal as a hedge during turbulent times in global markets,” he said.

Others predict the ongoing volatility of crypto assets. According to Sean McNulty, head of Asia-Pacific Derivatives at digital asset prime broker Falconx, the option offering downside protection for ether and Solana was purchased overnight. He added that Bitcoin’s next major support level is around $65,000.

“It appears that people gave up on a massive recovery of codes early in the year,” McNulty said.

More stories like this are available at bloomberg.com

©2025 Bloomberg LP