(Bloomberg) – The euphoria in the digital asset market, due to Donald Trump’s strategic cryptocurrency plan, turned skepticism on Monday, causing early losses in cryptocurrency that have worsened throughout the day as the US wins a 25% tariff for investors to impose 25% tariffs on Mexico and Canada.

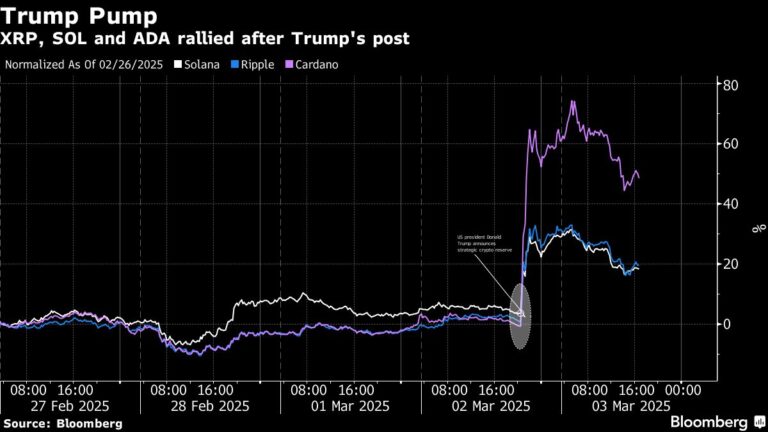

Trump said true socially on Sunday that XRP, SOL and ADA tokens will be included in the reserve along with Bitcoin and Ether. The news sparked an immediate crypto rally and provided relief to fresh asset classes in the worst month since 2022. However, the inclusion of three lesser known digital tokens was later met with questions from investors about the merits of the project.

All cryptocurrencies that Trump said were included in the reserves posted a sharp decline in New York by the late afternoon amid a major setback in risk assets that saw tech stocks cut the heavy Nasdaq 100 index by more than 2%. Most of the Sunday profits on the tokens have been wiped out.

The Bloomberg Galaxy Crypto Index fell almost 28% in February. The defeat put pressure on Trump back in the White House after the industry basked him with campaign contributions and praise. Even the reversal of the Securities and Exchange Commission’s long-standing crackdown failed to stave off sellers. This was partly due to tensions over Trump’s trade tariffs and gut trade tariffs and dramatic moves against dramatic government programs.

“For a president who has managed to be a market hero, the performance of risk assets last week was not exciting,” QCP Capital said in a memo on Monday. “The political calculus was clear. Trump needed a victory before his approval rating began to slip.

Bitcoin was almost 9% lower as of 3:20pm in New York, trading nearly $86,000, and ether lost about 16%. XRP slumped 18% after collecting 32% on Sunday, while Sol and Ada each skated about 19%. Trump’s prices have fallen as President Trump negotiates with the US and wins a 25% tariff reprieve that is scheduled to come into effect Tuesday, saying that he “is not left for Mexico or Canada” in the White House.

In its first statement on the creation of a cryptocurrency in January, the White House said such stockpiles could be “derived from cryptocurrencies legally seized by the federal government through law enforcement efforts.” Bitcoin tends to be the main crypto token seized by law enforcement, including the Bust of the infamous Silk Road website.

The initial announcement included little detail on how the reserve would be created.

Trump’s Sunday post just came as his crypto emperor David Sachs prepares to host the White House’s first industrial summit. On Monday, Sachs went to the X platform and announced that it had sold all its cryptocurrency holdings, including Bitcoin, Ether and SOL, before Trump’s administration took over in January.

XRP is a cryptocurrency associated with Ripple Labs Inc., operated by Brad Garlinghouse. Sol and Ada are native tokens for the Solana and Cardano blockchain. Below is a summary of the history of tokens and the people they link to.

XRP

Trump in February shares Coindesk’s story about Garlinghouse on the true social, and has been buzzing with both XRP fans (Ripple’s native token) and complaining among other crypto executives.

Gerlinghouse said in December that the company plans to donate $5 million worth of XRP to Trump’s inauguration festival. He and Ripple’s Chief Legal Officer Stu Aldeoty are photographed eating with the president at Mar-A-Lago.

That level of political access represents a tough reversal of the San Francisco-based company, sued by the SEC in 2020 and accused of providing unregistered securities. The US District Court found that XRP was later sold to institutional investors, but not when it was sold to retail investors, which was considered a victory in the crypto industry. The SEC sued the verdict. The SEC has repealed many crypto enforcement measures, but Ripple Appeal has not yet been abandoned.

Founded in 2012, Ripple, originally named Opencoin, was one of the previous companies that began developing distributed ledger technology for mainstream financial services. We have created our own platform with the goal of reducing the costs of resolving international payments.

Like many other blockchain startups that target traditional financial services flows, it has mixed results, and banks are slowing down adoption of technology.

Solana

Solana is the best blockchain for so-called memokine publishers, and yet it is a digital asset that is unlikely to be a balloon if it can attract the attention of social media users and can burst just as quickly as possible.

Trump and his wife Melania launched Memecoin in Solana in January. According to Coingecko data, the president’s tokens have fallen by about 80% from the all-time high of around $74. In February, Argentine President Javier Mairi was caught up in a political scandal after leading his followers to Memecoin named Libra in a post by X.

Released in 2020, Solana was closely linked to research by once-now restrained entrepreneur Sambankmanfried and his trading company, Alameda. The price of the token Sol fell sharply after Bankman-Fried’s Crypto Empire collapsed in November 2022.

It then hit a record high of $295 on January 19th after rebounding in 2024. The token then retreated 45% to trade for around $160.

Cardano

According to Coingecko records, Cardano, who has established himself as a rival to Ethereum, was launched in 2017 after raising more than $60 million through the sale of the token. Unlike Ethereum, considered the major commercial highway in the blockchain industry, Cardano struggles to charge a large market share in decentralized financial markets that rely on automated software rather than people to perform their functions.

Charles Hoskinson, co-founder and CEO of the company behind the Cardano blockchain, told us in a podcast posted on X shortly after Trump’s victory in November that he was helping us lawmakers shape crypto policy.

Watch: Charles Hoskinson of Bloomberg US IOG Singapore Pte Ltd.

According to data from Defilama, the total amount of assets locked on Cardano is currently at $607 million compared to around $90 billion at Ethereum.

– Support from Sidarta Shukla, Anna Irela and Emily Nicole.

(Prices will be updated in the sixth paragraph.)

Most of them read from Bloomberg BusinessWeek

©2025 Bloomberg LP