Since its launch as a ride service in Togo in 2018, Gozem has steadily expanded across French-speaking West Africa, integrating a wide range of services that have sought to become a super app. The company currently offers rides, commercial, vehicle financing and digital banking in Togo, Benin, Gabon and Cameroon.

Now, to expand its ecosystem, Gozem has raised $30 million in a Series B funding round ($15 million in equity and $15 million in debt), led by SAS Shipping Agencies Services and Al Mada Ventures. The company will use its funds to strengthen its automotive finance services and enter new markets.

Gozem is separated from other ride and vehicle financing platforms by ensuring drivers are financially safe and accessible to career growth opportunities, according to startup founders Gregory Costamana and Rafael Dana.

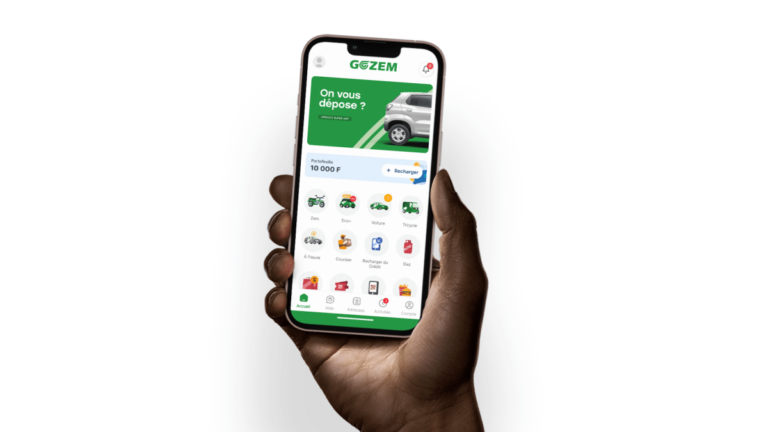

Gozem’s riding services cover motorcycles, three-wheeled vehicles and cars, but the vehicle funding products are intended to help drivers buy the vehicle. Workers on that platform can also deliver food and groceries as part of their e-commerce business.

“Our main clients are professional drivers,” Costamagna told TechCrunch. “We’re building an ecosystem to help drivers make more money and evolve in their lives. If they succeed, our entire business is successful.”

When it covered Gozem’s $5 million Series A in 2021, it piloted the vehicle’s fundraising model, partnered with local banks, deploying over 1,500 vehicles that year. Since then, the company has worked with International Lenders and International Finance Corporation (IFC), and now funds around 7,000 vehicles.

To attract drivers to its platform, the company uses a mixture of debt and stocks to purchase vehicles, allowing drivers to pay installments to these vehicles. Instead of requiring advance deposits, Gozem collects costs through small deductions from drivers’ daily income. Uber-backed Move, Asaak and Max provide vehicle funding to drivers across a variety of markets.

Gozem said its program ensures that payments remain affordable compared to driver average revenue.

“We explain to all drivers that this is a long-term journey,” Costamana said. “We fund their bikes, but they can upgrade to (three-wheeled vehicles), then cars and eventually become car owners.”

The founder said that the majority of the debt raised was planned for Gozem’s vehicle financing. The company is also working to raise another $20 million over the coming months to help French-speaking Africa expand across the next two years.

Play the Super App

Many fintech and mobility platforms have sought to integrate diverse services under one super app, but the model has not always been successful. In sub-Saharan Africa, for example, payment apps that have tried to evolve into super apps have rarely succeeded, such as SoftBank-backed Opay.

But Gozem is seeing traction thanks to a similar approach to Southeast Asian delivery and riding giants Grab and Gojek. Some of the bonded-back rivals, such as Yassir and Mnt-Halan, have also successfully investigated similar models from the Maghreb region and Egyptian Africa.

The company currently has nearly 10,000 registered drivers, and over 1 million users have used the platform so far. It says that the monthly user number is hundreds of thousands of people.

In addition to core services, Gozem has seen the growth of digital tickets, part of its commerce division. The company says it has resold event tickets across the market and processed more than 50,000 tickets in Togo alone for major concerts and events.

The company also entered digital banking (Gozem Money) in 2023 through its acquisition of Moneex. The service, which now lives in Togo, uses mobile payments by users, and according to the company, processes millions of dollars every day.

Before this latest Series B, Gozem recorded a $50 million run-rate gloss product value on three products vertically. Dana said the company hopes to triple or quadruple growth in the new capital in 2025.

He noted that the Series B funding round examines Gozem’s model. SAS Shipping Agencies Services is part of MSC Group, one of Africa’s largest container terminal operators, and Al Mada Ventures is the venture arm of Pan-African Financial Services Conmlomate al Mada.

“It’s a test because investors are operating on the ground in the same market we operate,” Dana said.