Regions like the US and Europe have doubled the reconstruction of industrial muscle after decades of closing factories and outsourced work to countries like China.

So, a rapidly growing Polish startup called Nomagic, which builds robotic arms for picking, packing and moving its logistics business, has raised $44 million in funding. The company plans to use the funds for both technology and business development. This includes disruption of initial efforts to sell the robots in non-European customers, particularly North America.

The investment is not only remarkable about its size, but also about who is funding and what is happening in the wider industrial environment.

The perennial issues when considering ways to make yourself competitive again in the industry are fundamental. The majority of the workforce that operated factories and warehouses in the past moved to other jobs. And in spaces where that’s not happening, industrial operators are improving efficiency by reducing the number of workers, reducing labor costs and bringing more automation.

Advances in technology also raised more existential questions. What is the outlook for humans in a world dominated by AI and robots? The early conflict highlighting that question did not work. For a recent example, see this virus story from the Y-combinator startup that built an AI-based workplace observer and highlight the backlash that caused workers when they were lazy. Is “sweat shop as a service” a new Saas? the critic asked.

Unfortunately, being furious does not mean that such technology is not built, nor does it mean that humans will not become obsolete with some features. It points to the ongoing discussion and struggles we continue to have and what we need to deal with.

Nomagic’s funding appears, in part, to be a signal that shows how the world is being formed.

The Series B leads are the VC division of the European Bank for Reconstruction and Development (EBRD), a development bank jointly owned by over 70 countries and two European Union agencies.

EBRD’s involvement here emphasizes the push for government and its institutions to spur private companies to support their mission to rebuild the industry. They see robotics and technology as key levers to help Europe compete again in the industry.

“Nomagic’s track record in the deployment of Advanced AI and Robotics Technologies, combined with its impressive growth trajectory, positions it as a leader in the warehouse automation revolution,” EBRD’s Bruno Lusic said in a statement. “We look forward to supporting our company as we continue to break new ground in this dynamic industry.”

Alongside EBRD, backers Khosla Ventures and Almaz Capital, who return top shelf, are participating. Also, with an additional signal of the institution’s mission, the European Investment Bank (EIB) is casting venture debt (the only type of investment).

For each pitchbook data, Nomagic appears to have raised about $30 million previously (it did not count EIB debt). The startup and its investors refused to give it a valuation, but Khosla’s partner Kanu Gulati confirmed with TechCrunch that it was in fact a “up” for the startup. We’ve previously introduced startups and their technology here and here.

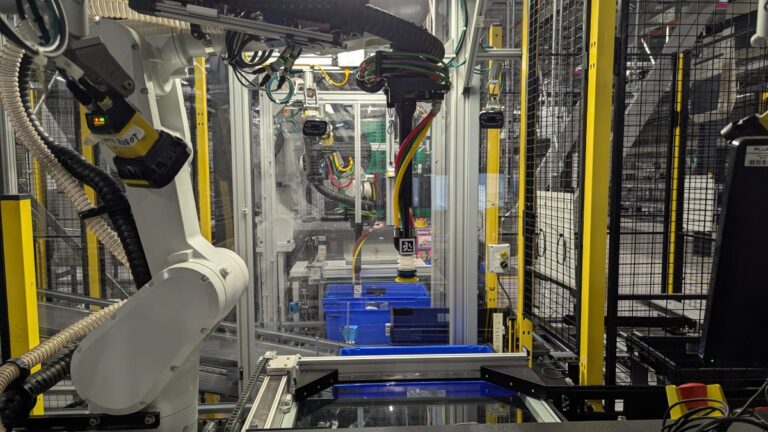

The key to Nomagic’s robot arm is that unlike many other robot startups, it is not a hardware breakthrough.

“Most of our hardware is off the shelf,” said CEO Kacper Nowicki.

Instead, the company is focusing on software. I basically built a “library” of various objects and how to move, pack and process them using computer vision, machine learning, and other types of automation.

The robot is equipped with Nomagic’s AI to run in a wide range of use cases, making it relatively easy to redeploy on a case-by-case basis. This contrasts with how many robotic arms are built and operated, Nowicki said. D’Orgeval admitted it was a “paradox”, but Nomagic is not interested in building humanoid robots as many moving parts are best provided by wheels in industrial spaces.

The company says it increased its annual recurring revenue by 220% last year (although it doesn’t disclose the actual number), and says it has seen another 200% growth this year thanks to demand from general customers such as e-commerce and drugs.

Its customers include apo.com, arvato, asos, bracket, fiege, kulletet and vetlog.one.

Nomagic’s closest competitor, Covariant, was the subject of an interesting acquisition agreement with Amazon last year.

In July 2024, e-commerce Leviathan, known to be a large investor in its own warehouse robotics, hired the founder of Covariant and signed a major licensing agreement with the startup. To clarify it wasn’t a complete acquisition – the Covariant still operates as an independent company – but as a stadium where Nomagic may have a rating, Covariant reportedly was last valued in 2022 at around $625 million.

“Amazon” was a difficult problem to solve and we couldn’t solve it, so we got it,” said Khosla’s partner Gulati. “It’s Amazon. That shows that companies like Nomagic Worldwide have great opportunities.”

Nomagic, Covariant, and other companies in the space, such as Berkshire Gray and Righthand Robotics, are developing their technology as robotics increasingly marks in industrial environments.

Large companies such as Nvidia and Softbank (which acquired Berkshire Grey in 2023) have identified opportunities to build for the markets highlighted by two currents. Large companies are slowly upgrading legacy equipment, building physical spaces for partners to build up physical spaces for new equipment greenfield opportunities.

The role of government should not be underestimated by this trend. The UK, the European Union, the US and other regions are all looking for more investment in industry, and they will spend more money behind that order.