Treehouse CEO Brandon Goh recently discussed the potential of bonds in decentralized finance (DEFI), calling it a key factor in the sector’s institutional adoption. In an interview on the podcast’s hashout, Goh explained that Defi saw growth in products such as decentralized exchanges and lending platforms, but lacked bonds, a core component of traditional finance. Goh stresses that bonds, including assets such as bonds and savings accounts, form the backbone of traditional finances, but that they are not included in the Defi Ecosystem presents a barrier to wider institutional involvement. did.

One of the main challenges of introducing bonds to Defi is the lack of standardized benchmark fees, such as the London Interbank Offering Rate (LIBOR), commonly used in traditional finance. Goh noted that without these basic benchmark rates it would be difficult to scale fixed income products in a distributed environment. He believes this gap is one of the reasons bonds are barely present in the current defi landscape.

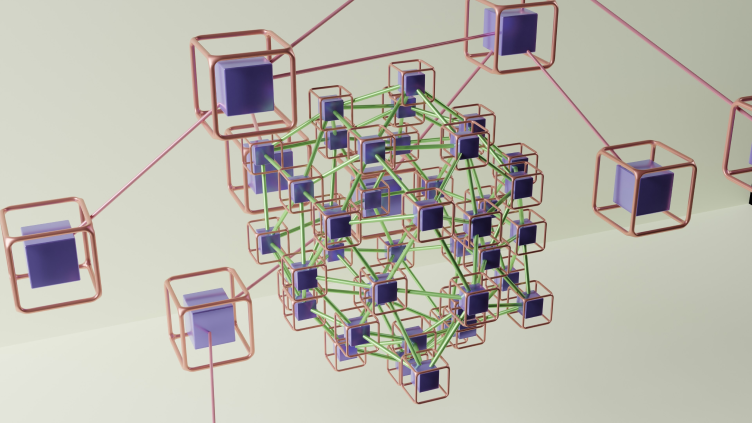

Treehouse, a platform co-founded by Goh, aims to address this issue by combining traditional fixed income products with the flexibility of Defi. Through its platform, Treehouse offers users a way to earn predictable returns, making it easier for investors to manage the risks of yield-generating products. This approach is designed to provide both stability and transparency. This is an important factor that can attract institutional investors to the Defi space.

Furthermore, Goh highlighted the importance of creating on-chain benchmarks such as decentralized delivery rates (DORs) to improve market efficiency and transparency. He explained that Treehouse’s model uses these tools to provide a safe and reliable investment environment, helping to bridge the gap between traditional finance and emerging Defi markets.

The conversation also changed how much larger financial institutions will be involved with Defi in the future. Goh suggested that while these agencies may be cautious about participating in high-risk Defi products, they may be more likely to adopt stable, transparent options like staking. He predicts that as regulatory clarity improves and Defi infrastructure becomes more robust, bonds could play a key role in the next phase of Defi’s growth.

Treehouse’s work to introduce bonds to Defi represents a critical step in the maturation of the sector. The combination of traditional financial models and distributed technology allows Treehouse to provide the stability it needs to attract players in the institution. As Defi continues to evolve, Goh’s vision for bond products may help lay the foundations for a more stable and widely accepted decentralized financial ecosystem.