(Bloomberg) – The ripple effects of President Donald Trump’s pro-crypto agenda have driven a surge in Bitcoin demand in Japan. There, pivots for one hotelier to stockpile cryptocurrency offers shareholders eye-catching returns.

Most of them read from Bloomberg

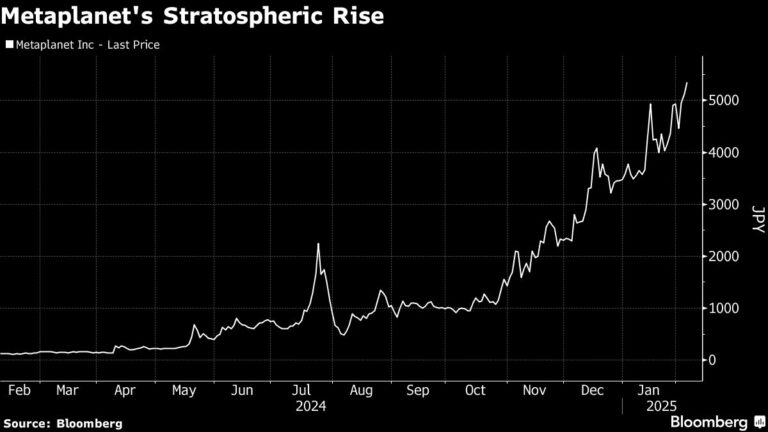

Metaplanet Inc. stock has grown more than 4,000% over the past 12 months, making it the largest profit of all Japanese stocks in that period and the highest in the world, according to data compiled by Bloomberg. Masu. Bitcoin itself hit a record high of $109,241 on January 20, as Trump was sworn in for his second term on January 20, but since then, trade policy has been experiencing global instability. They incited them, and they erased those benefits.

Metaplanet is one of many costumes around the world that aims to emulate the success of Michael Saylor’s strategy, formerly known as Micro Strategy Inc. 1 billion tokens.

Simon Jerovich, a former Goldman Sachs equity derivatives trader and CEO of Metaplanet, said he was drawn to the idea after hearing about Saylor’s strategy on the podcast. He ran Metaplanet, a former Red Planet Japan Inc. as a hotel developer since 2013, but in early 2024, he forced the pandemic to shutter everything except hotels. We have moved to the “Bitcoin First Strategy.”

Since then, Metaplanet shareholders have grown to almost 50,000, and by 2024 it has increased by 500%. Shareholders include capital groups that also invest in strategies, but the majority are retail investors, many of whom have limited experience with volatile crypto assets.

“Metaplanet has a very high exposure to volatile retail bases,” said Rhiannon Ewart-White, Japanese equity analyst and managing director of UK-based Storm Research. It’s there. “They need to make sure that shareholders understand exactly what their strategy is.”

The company, which has recorded a sixth consecutive loss, forecasts its fourth quarter revenue earnings, which will be released in Tokyo later on Monday. It is likely to strengthen the stock, Ewart-White said.

Jerovic, who attended Trump’s inauguration in Washington last month, told Bloomberg in an interview that “excitement about a more Bitcoin-friendly regulatory environment” in the US has driven demand for tokens in Japan.

The story continues