(Bloomberg) – After surpassing most asset classes in 2024, Bitcoin has returned to Donald Trump’s White House, increasing geopolitical instability and hastily invested in safe shelters I realized I was under pressure because I was there.

Most of them read from Bloomberg

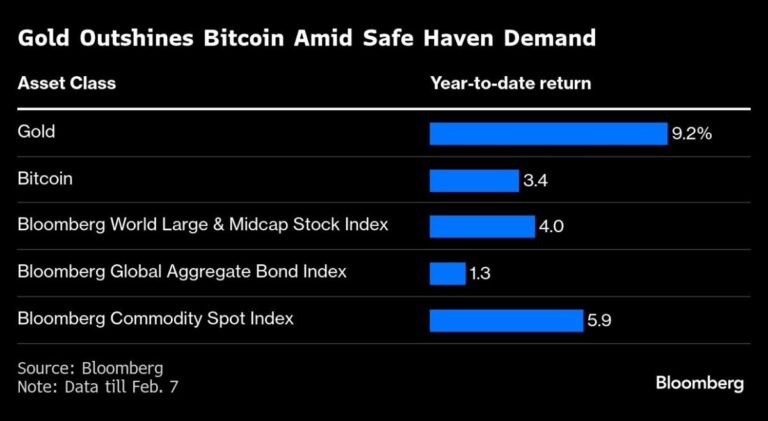

Bitcoin has boosted the 9% jump in gold, just over 3% since the start of the year, according to data compiled by Bloomberg. Precious metals reached a record high of $2,882 per ounce after President Trump said he could take over Gaza on February 4th. Bitcoin is currently about 10% below its peak.

Bitcoin is described as a storage for similar value as gold, as its built-in scarcity (its supply concludes with 21 million yen), but tokens are not holding back the bill. Economical Gold’s enduring appeal in an era of chaos has been amplified by recent developments such as the US-China trade war and tariff threats. In contrast, Bitcoin has often moved with technology inventory and almost lockstep .

Bitcoin could be seen as a hedge against Fiat currency, but its appeal is silenced in a market where the US dollar remains in high demand, says Aoifinn Devitt, senior investment advisor at Moneta Group LLC, on Bloomberg TV He said in an interview with “In the end, there are unique characteristics that act separately from the market, but at this point it is acting as the most risky behavior of risk-on assets,” Devitt said.

Still, Bitcoin supporters hope that the essential qualities of tokens will act like they will resemble a storage space in the future. The emergence of funds traded on exchanges that invest directly in the largest digital assets, “will see investors gradually reduce volatility and chasing the move towards riskier cryptocurrency assets.” said Wincent, senior director of market makers.

Most of them read from Bloomberg BusinessWeek

©2025 Bloomberg LP