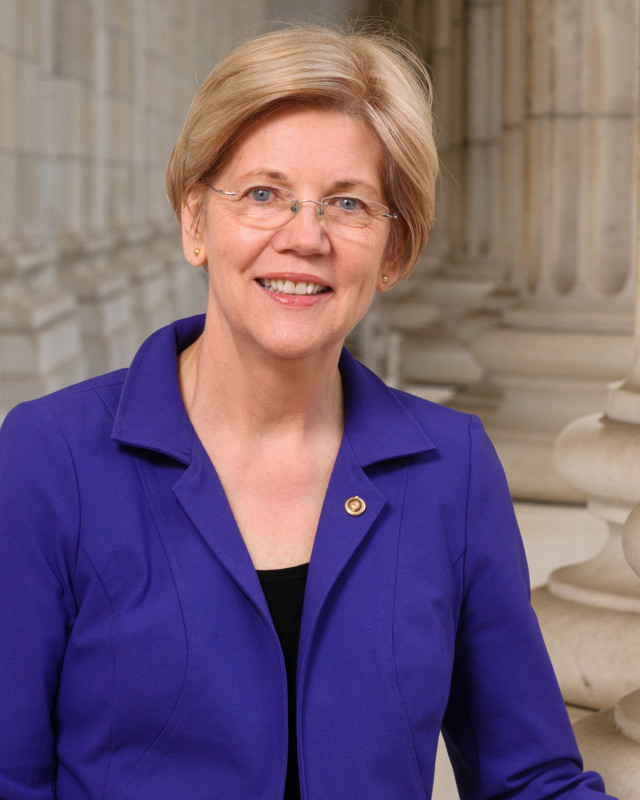

Massachusetts Senator Elizabeth Warren has long been called “anti-crypt” by industry executives and has earned a common cause with the crypto sector, Battle Bank.

On Tuesday, Warren wrote to President Donald Trump, recommending him to look into patterns of desertion of legal clients in the banking industry. She cited more than 8,000 consumer complaints about account closures and called on Trump to take action against major banks engaged in the practice.

Members of the Crypto industry have also long appealed to access or maintain banking services by financial institutions regularly closing or freeing accounts. Some crypto companies, like Coinbase, have spent years fighting and putting up with legal battles to highlight bias towards the industry when protecting banking services. On Wednesday, a new cache of documents was shown to help companies whose banking services have been denied to see some instances.

Despite linking cryptography to illegal activities and North Korean cybercriminals, Warren came out in defense of crypto companies worthy of banking services. During a Senate bank hearing Wednesday, Warren told the CEO of Crypto Infrastructure Provider Anchorage Digital, “I don’t think we should be locked out of the banking system.”

“Banks may have a legitimate reason and legal obligation to freeze or close their bank account,” Warren’s letter to Trump said. “But banks may be implementing these legal obligations in a sloppy and overload.”

Leaving off is the reason Trump himself opposed particularly conservative voices. “Many conservatives have complained that banks don’t allow them to do business within the bank, including a place called Bank of America,” Trump said. He spoke at the World Economic Forum in Davos, Switzerland last month. “They don’t have conservative business.”

For years, the Crypto Industry has criticized the SEC’s 2022 Staff Accounting Breaking News 121 (SAB 121). This has made it difficult for banks to serve crypto customers by increasing their regulatory burden and highlighting risks. This indirectly contributed to the decheating, Crypto said.

“SAB 121 was a major barrier to US banks that hold crypto for their customers because they recorded it as balance sheet liabilities, and ultimately the banks were safe for consumers. This is because it made it difficult to provide sound digital asset services,” said Seamus Rocca, CEO of Xapo Bank, a bank based outside the US, with a cryptocurrency origins.

The story will continue