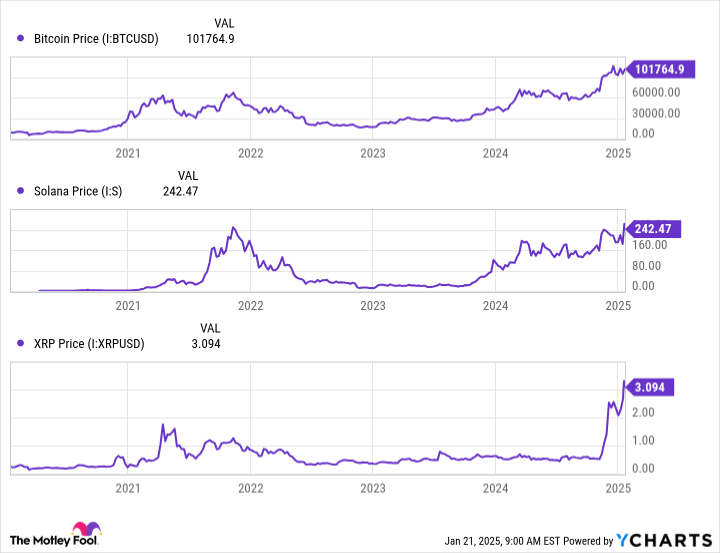

A very important coin like Bitcoin, (Crypto: BTC) Solana, (Code: Sol) and XRP (Crypto: XRP) Hovering near all-time highs, it’s a good time to be a cryptocurrency investor. And soon, some new developments waiting in the wings could make it an absolutely great time.

The catalyst that could lead to a new gold rush for these currencies is potentially before the end of the year.

By now, you’ve probably heard that the new Trump administration is floating the idea of a Strategic Bitcoin Reserve (SBR). So far, based on discussions with the presidential transition team, some investors are predicting a formal policy update within the first 100 days of the new administration, although there is no guarantee that such will pass. I’m doing it.

It will be Bitcoin’s powerful catalyst Whopper sometime in the first quarter of this year. There is perhaps no stronger support for a coin’s value than that of the U.S. government. If SBR is created, it will be a major affirmation of Bitcoin’s core investment thesis.

But the new administration may not stop at creating the SBR. Recently, the idea of SBR has been expanded into what could become a national cryptocurrency repository. If implemented, the concept would mean the government could purchase Solana, XRP, and possibly other major US-based cryptocurrencies.

In short, providing widespread buying pressure with the government’s economic weight could send these coins higher than investors expect in the long term, and could start happening soon.

The cryptocurrency market is very sensitive to borrowing costs.

As interest rates rise, the attractive yields on risk-free Treasury bills give investors no reason to buy more speculative assets like cryptocurrencies. In contrast, when it’s cheap to borrow money, investors have to take bigger risks to get solid returns because sitting on the safest investments no longer offers favorable yields.

In that vein, Bitcoin, Solana, and XRP are all assets that gain as interest rates fall. It is natural to expect more money to flow into crypto if the Federal Reserve continues its campaign to roll back interest rates in 2025 as it did in 2025.

But the U.S. Federal Reserve is not alone in reducing borrowing costs. Many international central banks, including the UK, EU and China, are considering or have already reduced their fees as well. And while it’s not certain that investors in these areas will flock to these leading cryptocurrencies right away, at least some of them will probably show up in some of their capital cities over the next few years.

story continues